The capital markets have changed considerably recently, forcing regional stock exchanges in Germany to rethink their business models to secure their long-term relevance. Can they survive through innovation and new offerings — or is their survival at risk? This article examines the current situation, competitive advantages, modernised platforms and the international orientation of regional stock exchanges.

Regional stock exchanges such as Stuttgart, Munich, and Hamburg traditionally play an important role as a platform for the listing and trading of securities of small and medium-sized companies. These exchanges often offer specialised markets that are tailored to the needs of these companies. For example, the stock exchanges in Munich and Stuttgart are characterised by innovative platforms.

Nevertheless, their influence is limited compared to large trading centres. The overall market share is largely dominated by electronic exchanges such as Xetra or Tradegate Exchange, which leads to increased competitive pressure. To withstand these challenges, regional exchanges must focus more on specialised offerings, innovative strategies and niche markets. They also face the challenge of keeping pace with increasingly complex regulatory requirements despite their limited size.

Although the large, international exchanges constitute the majority of the market, regional exchanges offer specific advantages that differ from those of the larger players. A key competitive advantage of regional exchanges is their proximity to certain markets and their flexibility in introducing new trading instruments. The Hamburg Stock Exchange and the Hanover Stock Exchange, for example, offer attractive conditions for trading in closed-end funds, which has long made them popular trading centres for niche products. 1

Another advantage lies in the expertise and trading offerings aimed at local and national investors. The regional exchanges can score points here with their customised approach and benefit from their proximity to specific investor groups. For investors who are less interested in the international markets and focus on specialised German products, they offer an attractive alternative and are often the first port of call. 2

Up-and-coming neobrokers such as Trade Republic and Scalable Capital have changed the market. With low-cost, user-friendly platforms, they are increasing the competitive pressure on traditional exchanges. At the same time, however, they open up opportunities: many neobrokers conduct their transactions via platforms such as Gettex or LS Exchange. This increased trading activity by small investors strengthens the position of regional exchanges and enables them to benefit from digitalisation.

The regional exchanges have recognised the pressure to act and are increasingly mobilising resources to take measures that monetise their advantages over the major exchanges. To remain competitive, regional exchanges are increasingly focussing on digital innovations and modern platforms. One example of this is the increased use of Blockchain-Technologie, which is being used at the Stuttgart Stock Exchange to make trading in cryptocurrencies secure and transparent. 3 In addition, the Munich Stock Exchange is investing heavily in automated trading solutions via its Gettex platform, which are particularly tailored to the needs of private investors. 4 The introduction of electronic trading platforms such as Quotrix 5 at the Börse Düsseldorf and other technology-supported models also show how the regional exchanges are focussing on digital transformation.

In addition to blockchain technology, the use of artificial intelligence is also being researched in various areas, such as improving trade execution and optimising analysis tools. Modern trading platforms offer integrated analysis and automation functions that give private investors in particular access to more complex investment strategies. 6

All three examples are promising projects by individual exchanges that show the way for regional exchanges to remain competitive in the future. It is now up to other exchanges to follow suit and set an example.

A central building block for the success of regional stock exchanges is their international orientation. Co-operations with global custodians and the introduction of cross-border products expand the offering for German customers and attract international investors. This enables the stock exchanges to strengthen their market presence.

One example is Börse Stuttgart, which provides access to a sustainable, global index with the Amundi S&P 500 ESG ETF. Such products connect international markets with local investor needs and strengthen the position of regional stock exchanges in global competition. At the same time, they emphasise the importance of sustainable financial instruments, which are attracting more and more investors.

Regional stock exchanges in Germany must consistently modernise their business models to remain relevant both nationally and internationally. Their strengths — niche markets, proximity to local companies and specialised offerings — continue to be a decisive competitive advantage. However, without technological innovation and a stronger international focus, they risk losing importance. The next few years will show how successful they are in shaping change.

Consileon’s extensive experience in strategic consulting projects is reflected in the successful implementation of numerous initiatives for our clients.

One example of our work is the strategic analysis of post-trade options for a regional stock exchange when introducing new products. In workshops with specialist departments and the Executive Board, settlement strategies were identified and evaluated in terms of feasibility, costs, and flexibility. In addition, we analysed pricing models and developed well-founded recommendations for optimising the settlement processes.

In another project, we supported a company in realigning its strategic objectives. We analysed success factors in the areas of company, market, and technology and developed clear recommendations for action on this basis.

We have also supported pioneering projects in the area of digital innovation. For a digital post-trade platform in accordance with eWpG we supported the transformation of processes and the IT landscape, the onboarding of pilot customers and the design of a distributed network.

Are you seeking a trustworthy partner with capital market expertise for your strategic project? Then get in touch with us.

Sources

With TISAX (Trusted Information Security Assessment Exchange), the ENX Association offers a standardised platform for the mutual acceptance of information security assessments in the automotive industry on behalf of the German Association of the Automotive Industry (VDA). This initiative is of key importance as it covers the entire supply chain – including external service providers.

TISAX assessments are carried out by assessment service providers, who provide proof of their qualifications at regular intervals. The resulting assessment results are only accessible to authorised participants and thus protect sensitive information from widespread public access.

For us at Consileon Business Consultancy GmbH, ensuring the confidentiality, availability, and integrity of information is a central component of our work. We aim to guarantee the highest standards in the area of information security and to offer our customers a trustworthy environment.

We have been fulfilling the requirements of the VDA ISA information security standard since 2020. Audits are carried out at regular intervals by an accredited audit service provider to ensure that we are always up-to-date with the latest security requirements.

The results of our TISAX assessment are only available to authorised participants via the ENX portal. Interested parties can view our certificate via the following link: ENX TISAX Assessment Results.

With TISAX, we are sending out a clear signal in favour of information security and trust – for us and our customers.

The implementation of the NIS2 Directive is imminent and will significantly tighten the existing requirements in the area of cyber security. While the existing security requirements mainly affected large operators of critical infrastructures, the focus is now increasingly shifting to SMEs. The new regulations significantly expand the scope of application, meaning that many sectors and companies will be obliged to review their IT security precautions in future and adapt them if necessary.

But what does this mean for you and your company in concrete terms? What measures are required to meet the new requirements and close security gaps? Careful planning and strategic implementation are crucial in order to minimise risks and meet the legal requirements.

In order to prepare companies specifically for the upcoming changes, ZIRNGIBL Rechtsanwälte, V-Formation GmbH and Consileon cordially invite you to a joint online webinar on 26 November 2024 from 9:30 to 10:30 am. In this interactive seminar, we will offer you practical insights and comprehensive solutions that will enable you to implement the NIS2 requirements in a legally compliant and efficient manner. The webinar is aimed at managers, IT managers and compliance officers who want to find out about specific measures and the practical requirements of the new regulations.

During the 60-minute webinar, you will learn everything you need to know about the implementation of the NIS2 directive and how you can strengthen the security of your digital structures in the long term. The experts present will give you specific recommendations for action and address all the key aspects:

Find out which sectors and company sizes are affected by the new directive and what this means for your organisation.

The experts will show you how you can implement the new requirements efficiently and in a resource-saving manner – from taking stock to implementing the necessary security measures.

We explain the legal consequences of the NIS2 directive and show you how you can optimise your company’s compliance.

Participation in the webinar is free of charge and offers you the opportunity to find out about current challenges and solutions and to enter into a valuable exchange with experts and other companies. The number of participants is limited, so reserve your place now and prepare your company for the future requirements in the area of cyber security!

Agilität wird oft als die Antwort auf die Herausforderungen der VUCA-Welt (Volatility, Uncertainty, Complexity, Ambiguity) gesehen. Viele Organisationen setzen auf agile Methoden, um flexibler auf Marktveränderungen, Kundenanforderungen und interne Herausforderungen reagieren zu können. Doch trotz anfänglicher Begeisterung kommt es oft zu Ernüchterung, wenn die gewünschten Ergebnisse ausbleiben.

Die Gründe dafür sind vielfältig, doch eines der zentralen Probleme liegt darin, dass vielen Unternehmen das nötige Verständnis für eine nachhaltige agile Transformation fehlt. Agilität bedeutet nicht, starre Strukturen einfach aufzulösen oder jedes Problem mit agilen Methoden zu lösen. Vielmehr bedarf es einer durchdachten Herangehensweise, die an die individuellen Anforderungen und Rahmenbedingungen des Unternehmens angepasst ist. Hier setzt die Agile Management Maturity Map (AM³) an.

Entwickelt von der Fachgruppe “Agile Management” der Deutschen Gesellschaft für Projektmanagement e.V., zu der auch unser Experte Rüdiger Lang gehört, bietet das AM³-Modell eine Reifegradlandkarte, die Unternehmen hilft, den optimalen Grad an Agilität für ihre spezifischen Bedürfnisse zu bestimmen. Denn vollkommene Agilität ist nicht immer sinnvoll oder möglich – jede Organisation hat ihre eigenen Anforderungen, die berücksichtigt werden müssen.

Das Modell basiert auf einem systemischen Ansatz und bietet klare Leitplanken für den Transformationsprozess. Es hilft Unternehmen zu erkennen, in welchem Reifegrad sie sich befinden und welche Schritte notwendig sind, um die nächste Stufe zu erreichen. Dabei werden sechs zentrale Dimensionen betrachtet, die die Umsetzung agiler Prinzipien in Organisationen steuern. Diese reichen unter anderem von der Kundenorientierung bis hin zur Förderung einer agilen Lernkultur.

Die Agile Management Maturity Map AM³ ermöglicht es, Agilität gezielt und effizient in Unternehmen zu integrieren, ohne dabei den Überblick zu verlieren. Es ist ein praxisnaher und ganzheitlicher Leitfaden, der Unternehmen dabei unterstützt, ihre eigene agile Reise zu gestalten – immer mit Blick auf die jeweilige Branche, Unternehmenskultur und spezifischen Herausforderungen.

Für weitere Informationen und eine detaillierte Erklärung der AM³ sowie deren Nutzen für Ihr Unternehmen auf dem Weg zur optimalen Agilität, lesen Sie hier den vollständigen Fachartikel.

Who supports you with data analysis and forecasting? Which AI delivers optimal results in areas such as support, personalization and predictive maintenance? And which service provider has the necessary expertise? Together with Statista, brand eins magazine has selected the leading IT service providers of 2025 for the sixth time. This year, the Consileon Group was once again able to impress with its outstanding performance.

The list of the best IT service providers in Germany is based on a survey conducted by Statista and brand eins among experts (IT service providers, IT freelancers) and customers of IT service providers (e.g. employees of IT departments and IT purchasing decision-makers).

Experts and customers were specifically invited to take part in the survey by e-mail with a personalized link. Other participants were also able to register via a registration page by providing their professional email address in order to receive a personalized survey link.

Additional experts and customers were also recruited via a professional online access panel. The survey ran from April 16 to May 19, 2024, and a total of 4,711 people took part, including 2,465 experts and 2,246 customers. The survey was conducted exclusively online.

The companies were rated on a scale of up to four points. The top 25% of the companies listed achieved the maximum rating of 4/4 points, the next 25% received 3/4 points and so on. Just being included in this ranking and being awarded 1/4 points is an outstanding achievement and underlines the high level of recognition and trust placed in us in the market. You can find out more about the methodology here.

The Consileon Group is extremely proud and would like to express its sincere thanks for this award.

The crash of the Nikkei index on 5 August 2024 – the biggest since 1987 – and the global sell-off that followed it have underscored just how volatile stock markets have become. To identify risks at an early stage, prevent losses and take their chances, players are increasingly looking at sentiment and fluctuation indicators such as the CBOE Volatility Index (VIX), also known as the “fear index”. Based on gauges like the VIX, market participants are reviewing and updating their risk management.

Volatility has risen alongside the largely politically driven exacerbation of the vulnerability of both the global economy and the biophysical environment on which it depends. A surge in geopolitical tensions, wars, terrorism, natural disasters and pandemics like Covid -19 has put global supply chains including energy resources under unprecedented strain. Escalating risks have heightened uncertainty, spurring market participants’ nervousness, which reflects in more volatile prices.

Another factor that impacts investor behaviour is central banks’ monetary policy. Interest rate hikes, whether upwards to curb inflation or downwards to stimulate the economy, usually lead to falling or rising stock prices respectively. Last but not least, investor expectation and, consequently, market volatility tend to react to economic indicators such as GDP growth, inflation rates or employment statistics.

From stock option prices, the CBOE Volatility Index calculates the fluctuation range of the S&P 500 for the next thirty days. The VIX is regarded as indicative of investor sentiment on the entire US stock market. As it mirrors market stress, it is also known as fear index or fear gauge . Banks and other financial service providers look to it as it correlates with stock market returns. Thus it serves as a leading indicator for market players to readjust their risk management.

In the financial sector, an essential hazard is credit risk – the danger that borrowers might default on all or part of their debt. Market risk materializes when an asset loses value due to rising inflation, for instance. Liquidity risk increases when many clients withdraw their deposits at short notice, making it more difficult for the bank to service its liabilities. In addition, institutions operating internationally need to manage foreign exchange (FX) risks.

Quantifying risks like the above is quite a challenge; minimizing them requires a set of well-matched measures. A common method comprises periodic stress tests based on extreme but plausible scenarios such as sharp rises in interest rates, legislative changes, pandemics, natural disasters or geopolitical tensions. To hedge against FX or interest rate risks in particular, derivatives like options or futures provide a flexible approach.

Lately, tech companies catering to the financial sector have launched machine-learning AI apps that help market players analyse big data for risks and trends in real time, comply with regulatory requirements and sustain the market’s unrelenting pressure for maximum efficiency. Given that such systems are bound to be state of the art among competitors soon, investing in them has become imperative.

By providing holistic, bespoke solutions, Consileon enables financial service providers to master market volatility and keep risks under control. Among other things, we build a smart surveillance system that constantly tracks and evaluates risks relevant to your lines of business. Based on your criteria, our automated „Lighthouz“ test suite thoroughly examines the output of all your AI services including those employed in risk management. We analyse and document IT architectures complete with interfaces to detect any need for action in internal or downstream systems at an early stage.

Detection and prevention matrices tailored to your business draw your attention to underrated risks before any damage occurs. Our real-time dashboard helps managers make well-founded decisions even when time is scarce. We support your projects to ramp up your volatility and risk management all the way from strategizing to organizational and technical implementation, and on to integration in your live systems. Detailed checklists provided by Consileon make it easier for you to future-proof your IT.

Given a perilous combination of mostly politically and ecologically driven megatrends, the current financial market volatility is more likely to increase than remain episodic. To stay competitive, banks and other financial service providers must face this uncertainty, measure the risks, keep them from materializing and prepare for worst cases. By setting up an agile, holistic, state-of-the-art risk management function, market players can boost their resilience and hold their own even in difficult times.

Every year, the renowned business magazine Handelsblatt selects the Top Consultings in various consulting fields. This year, we are delighted to have been named Top Consultant in 13 categories! This recognition underscores our ongoing commitment and broad expertise, which we use to provide our clients with first-class advisory services.

The survey was conducted by the Handelsblatt Research Institute (HRI). The Handelsblatt explains the survey as follows: HRI identified a peer group of 15,700 management consultants from over 325 consulting firms. They were then asked about the most renowned companies in the respective consulting fields. The top lists created are based on the results of this survey.

The consulting industry is changing and increasingly has a strong focus on the ecological transformation of the economy. According to Handelsblatt, the consulting fields of energy, sustainability and decarbonisation are seeing the highest growth with a 24 per cent increase in turnover in 2022. The need for expertise in these areas is growing and companies are increasingly looking for consultants to help them arm themselves against the energy crisis and other sustainability issues. Especially in the energy sector, different consulting fields are merging, such as the connection between mobility and municipal infrastructure. Topics such as hydrogen and energy storage are in high demand, leading to an increased need for specialised consultants in these areas.

In another article, Handelsblatt points out that at the same time a cultural change is taking place in the consulting industry. The possibility of part-time models is gaining in importance in order to attract sufficient junior staff. Long working days are no longer seen as a status symbol. Some consulting firms already offer part-time options to attract talented candidates. Working hours can be reduced on a part-time basis, but consultants need to remain flexible to meet client demands.

According to one of our recent surveys, many financial companies do see regulatory intervention from Brussels, for example, as a driver of innovation. Nevertheless, they shy away from the enormous effort involved in organisational and technical implementation. Particularly in the weeks immediately before and after the start of applicability, the changeover takes up resources that are lacking elsewhere.

To remedy this, the Consileon Group has developed an AI-supported ‘regulatory radar’ in collaboration with Professor Jan Pieter Krahnen, an expert in corporate finance and financial market regulation. Our subsidiary syracom is contributing its expertise in the field of regulation. The first version, which is now available, simplifies and accelerates the implementation of the EU resilience regulation DORA (Digital Operational Resilience Act), which has been in force since 2023 and will apply from January 2025. The regulation contains a number of highly complex requirements. Financial companies are now faced with the challenge of actually implementing all requirements correctly. The Regulatory Radar supports this process with four core functions.

Like all AI systems, the Regulatory Radar only does part of the work for the user. The focus is on highly formalised, schematic and therefore monotonous tasks. Here, AI reduces the need for personnel and significantly speeds up processes. Specialist staff are freed up in favour of strategic or value-adding tasks, and the company also saves on some external services. The high degree of automation prevents difficult-to-recognise, sometimes costly errors that can creep in during manual processing.

However, because artificial intelligence does not work cognitively, but statistically, humans always have the last word in Consileon’s solutions. They check the machine’s output, make improvements and add to it.

As additional protection against AI risks, we have integrated the quality assurance software of our technology partner Lighthouz AI into the Regulatory Radar. As part of an exclusive contract, Lighthouz ensures consistently high quality and reproducibility of the answers, recognises security gaps and helps to close them.

The potential benefits of an AI tool such as the Regulatory Radar are far from exhausted with the establishment of DORA compliance. Other regulations await their application in financial and real companies, including the EU AI Act, the GDPR, MaRisk, NIS-2, CSRD, the EU taxonomy and FATCA. Future versions of the Regulatory Radar will gradually cover these areas of application.

Consileon Austria hat vier von sechs Losen für Rahmenverträge der IT-Services der Sozialversicherung GmbH (ITSV) gewonnen und wird in den nächsten vier Jahren KI-Projekte für Österreichs Gesundheits- und Sozialversicherungsträger in den Kategorien ‘Speech Recognition’, ‘Knowledge Engineering’, ‘Natural Language’ und ‘Conversational AI’ umsetzen.

Ab heute schließt die ITSV im Rahmen ihrer Ausschreibung „ITSV2023/Artificial Intelligence Services/oV“ großvolumige Rahmenverträge mit der Consileon Business Consultancy GmbH ab. Der von uns gewonnene Rahmenvertrag umfasst 34 Millionen Euro in vier Losen und wird in den nächsten vier Jahren von Sozialversicherungsträgern wie der Österreichischen Gebietskrankenkasse, dem Arbeitsmarktservice und der Pensionsversicherung genutzt.

Wir haben nun die Möglichkeit, in folgenden Bereichen einen wesentlichen Beitrag zur digitalen Entwicklung des Gesundheitswesens in Österreich zu leisten:

„Wir freuen uns sehr, Österreich bei seinen Digitalisierungsprojekten zu unterstützen. Nachdem wir seit 2021 bereits rund 20 Rahmenverträge im öffentlichen Sektor gewonnen haben und nun allein bei der Bundesbeschaffungsgesellschaft (BBG) in 28 IT-Losen und sechs Rahmenverträgen gelisteter Partner sind – das sind mehr als die beiden größten Player in Österreich zusammen – haben wir nun die Möglichkeit, das Thema KI bei den österreichischen Sozialversicherungen voranzutreiben“, sagt Harald Kohlberger, Managing Partner von Consileon Austria. „Dieser Gewinn bestätigt den starken Fokus von Consileon auf Beratungsleistungen und Lösungen auf Basis von künstlicher Intelligenz. Die Speerspitze ist derzeit der eigens entwickelte Chatbot MyPersonalGPT und die KI-Qualitätssicherungslösung Lighthouz AI.“

Nicht vergessen wollen wir in diesem Zusammenhang unsere langjährigen Implementierungspartner, die zum erfolgreichen Abschluss so vieler Kundenprojekte beigetragen haben und deren wertvoller Beitrag zur ITSV-Ausschreibung uns zum bevorzugten Partner gemacht hat: Accso, cognify, Eraneos, ]init[, und Lufthansa Industry Solutions.

Über die Consileon-Gruppe:

Die Consileon-Gruppe vereinigt mittelständische Management- und IT-Beratungsunternehmen aus fünf europäischen Ländern. Seit 2001 bietet sie Strategieberatung inklusive organisatorischer und technischer Umsetzung aus einer Hand. Zu den Kunden zählen globale Konzerne, u.a. aus der Automobil- und Finanzbranche, sowie regional verwurzelte Großkunden und mittelständische Unternehmen und öffentliche Institutionen & Unternehmen der öffentlichen Hand. Die rund 520 Mitarbeiter unterstützen Unternehmen in allen Bereichen der Digitalisierung – von der Prozessberatung über die Implementierung bis hin zum agilen Change Management. Die Consileon-Gruppe deckt die gesamte Wertschöpfungskette ihrer Kunden ab und hilft, die Herausforderungen von morgen mit technologischer Expertise zu lösen. Weitere Informationen: consileon.de und www.consileon.at

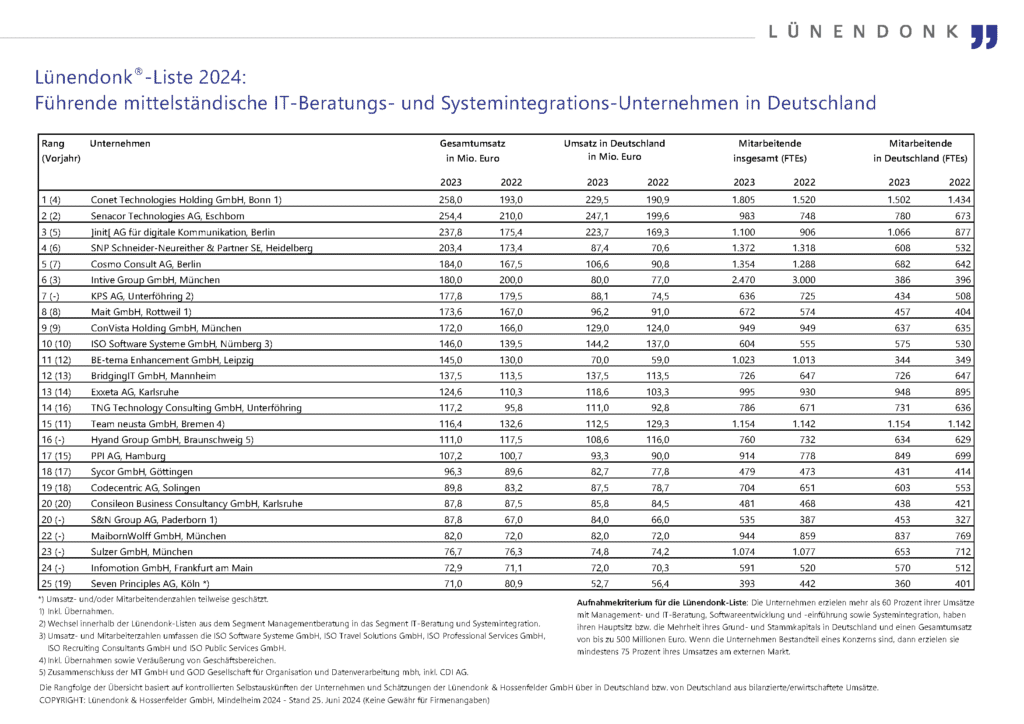

Consileon has done it again and is among the leading medium-sized IT consulting and system integration companies in Germany that are represented in the Lünendonk list!

The Lünendonk list is an annually published ranking of the 25 German IT service providers with the highest turnover. It is compiled by Lünendonk & Hossenfelder GmbH, a German market research and consulting company specialising in the IT and consulting sector. The list is based on turnover data and other relevant company key figures and serves as a guide to the IT market in Germany.

The Lünendonk list provides an overview of the scale and market leaders in the IT industry. It is often used as a reference by companies, clients, investors and other stakeholders to obtain information on the economic performance and growth of the IT services companies listed.

The companies on the Lünendonk list cover various areas of the IT industry, including IT consulting, systems integration, software development, IT outsourcing and other IT services, including Consileon. Placement on the list depends primarily on turnover, although other factors such as growth, number of employees and the strategic orientation of the companies can also be taken into account.