Automobile manufacturers usually give a warranty on the drive battery of an electric vehicle, which roughly corresponds to the average service life of a vehicle. This is in the range of eight years or 160,000 km. In practice, however, the batteries can also have a significantly longer service life. An initial indication of this is provided by vehicles at a Tesla rental in California, some of which have reached a mileage of up to 800,000 km without the need to replace the battery.

If the battery has only 70 to 80 percent of its original capacity left, after approximately 1,500 to 2,500 charging cycles, its performance is no longer sufficient for use in the vehicle. In this state, however, it makes neither economic nor ecological sense to dispose of the lithium-ion batteries. On the other hand, the batteries can continue to be used in stationary operation. Laboratory measurements have shown that due to the uniformly slow charging and discharging, use for up to 12 more years is possible. With average use, a traction battery would therefore only have to be disposed of after around 20 years.

For a holistic view of the battery life cycle, many automakers are also pursuing projects that help traction batteries have a “second life.”

Stationary large-scale storage facilities with retired lithium-ion batteries from electric vehicles are also already being used as intermediate storage for solar and wind energy. “Second Life” projects thus make it possible to link the transportation and energy transformation.

If the capacity of a battery is less than 30%, it must be recycled. In order to be able to reuse the large number of important and rare raw materials, companies worldwide are working on developing appropriate recycling processes. (Read more about the raw material extraction of a traction battery here) However, the number of traction batteries of electric vehicles to be recycled is currently still very small, which is why recycling on the industrial scale that will be necessary in the future is not yet possible.

The market leader in battery recycling is the Belgian company Umicore. The company uses the most common type of battery recycling to date: thermal fusion. The battery is first burned and then ground. The raw materials cobalt, nickel and copper are recovered in this way. However, lithium, graphite, aluminum and the electrolyte cannot be returned to the cycle in this way.

The German chemical company Duesenfeld has developed a different process. The highly flammable batteries are shredded under nitrogen until only crushed material and the electrolyte remain. 96% of all battery components, including the rare raw materials, are thus recycled and go into the (re)production of new traction batteries.

The Frauenhofer Institute for Materials Recycling and Resource Strategy (IWKS) relies on electrohydraulic shredding. In the mechanical process, the lithium-ion batteries can be disassembled by controlled shock waves, which requires little energy. Housing parts, electrode foils, separators and the active materials of the electrodes can then be separated and reused using specific separation processes.

The extent to which the challenge of sustainable recycling of lithium-ion batteries can be successfully mastered in the long term will only become clear in the course of the next few years. Automobile manufacturers are increasingly launching electric vehicles on the market, investments are being made in the expansion of a nationwide charging infrastructure, and the acceptance of electrically powered vehicles among the population is also steadily increasing. Used traction batteries will therefore come onto the market all by themselves, and existing solutions will have to be further expanded and innovative concepts found for their second life or recycling.

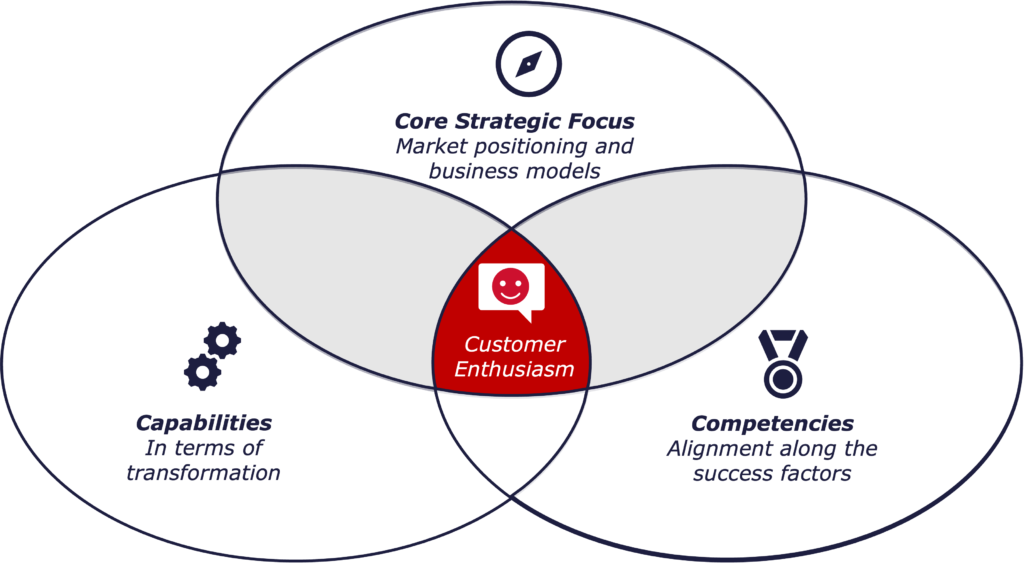

Our study “Retail Banking 2025 – Becoming a High Performer through Customer Enthusiasm” supports retail banks with the help of the holistic Consileon 4C model to sustainably secure their existence in an ambitious market environment and to exploit their potential for success.

In times when strategies no longer have a long shelf life, the ability to change becomes a decisive competitive advantage. With the Consileon 4C model, we give you the tool to be able to use this advantage for yourself.

As part of the Handelsblatt Tagung Zukunft Retail Banking conference, of which Consileon is the main sponsor for the 10th time in a row, our managing partner of Consileon Frankfurt, Ralph Hientzsch, presented the key findings of the study. On September 22, 2020, he spoke in Frankfurt about the future state of retail banking and presented our newly developed Consileon 4C model as a performance guarantor. Get the study and the presentation here.

A decisive factor for the breakthrough of electromobility on the mass market is the development of a universal charging infrastructure that is available everywhere. In recent years, various providers have developed in this area, but there is still no perfect solution for end customers to use throughout Europe.

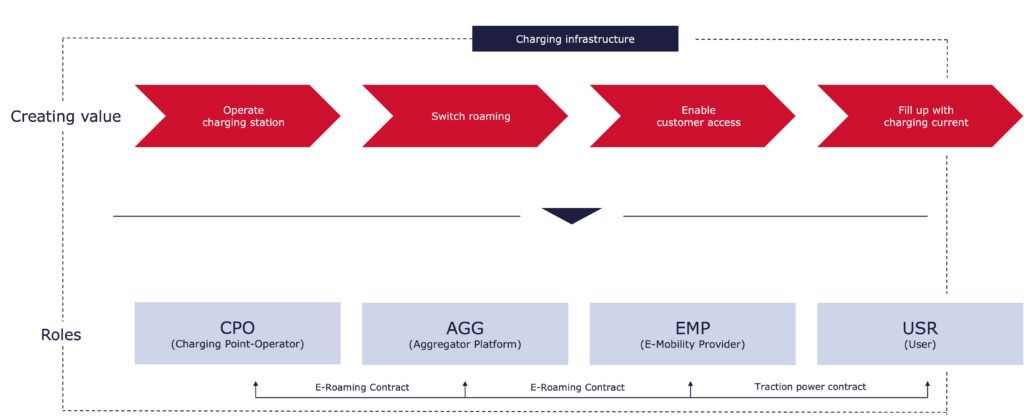

To understand the background and today’s challenges, it is necessary to look at the value chain of the charging infrastructure as a first step. This is defined by an orderly sequence of activities that ends when the car is charged for the end customer.

In the value chain, standardized roles have developed for the individual activities, which are largely performed by different companies. The following figure depicts the generic value chain with its assigned roles/actors, which are subsequently described.

The end customer (USR = user) purchases the service at the end of the value chain. His main goal – as familiar from the combustion engine – is to be able to use the widest possible range of charging options in the form of charging points on an ad hoc basis. To the annoyance of customers, the payment modes of the respective charging stations differ according to their operators. In addition to various payment options, they require membership and issue their own cards for this purpose.

The e-mobility provider (EMP) represents the interface between various charging station networks and the end customer. With its contractually regulated offer, the EMP enables the end customer to charge at third-party or different operators. It is not the operator of the charging points, but only offers their use to end customers. Customers pay a basic fee (e.g., €4.95 per month) and are thus also allowed to charge at partner companies. This option is referred to as e-roaming. The essential goal of the EMP is to maximize charging options for its customers – similar to what DKV does in the area of gas stations. For example, the company Plugsurfing is marketing an app that will enable payment at all charging points in Europe, regardless of operator or platform. This service works in a similar way to PayPal.

The chargepoint operator (CPO) operates its own charging stations for its end customers, but also offers its network service via a sales partner, the e-mobility provider. In this way, it also reaches end customers who are not customers of its own network. Due to the large number and variety of CPOs and their diverse, technical solutions, another role has established itself in the value chain, that of aggregator.

The aggregators (AGG) and their technical platforms represent the interface between the charging station operator (CPO) and the end customer’s contractual partner (EMP). The essential goal is to mediate charging station to e-mobility providers, in turn promoting their goal of highest network coverage. This is achieved by building a platform for different providers, such as Hubject, to implement real-time authorization of charging for end customers across providers. However, only very few providers are currently filling this role. The decisive factor for a successful business model is corresponding market power. The background to this is that the aggregator must not only have a contract with the respective partner (CPO and EMP), but also the CPO directly with the EMP.

For market entry as well as further development of the charging infrastructure, it is essential to know and understand the market participants and their different roles in the value chain.

Consileon considered and compared all European market players in the field of charging infrastructure based on the following criteria:

Similar statements have been circulating at regulars’ tables for quite a while. Media attention and enormous gains in the value of some shares in the field of hydrogen technology have certainly contributed to this image.

A brief look at the technology reveals that vehicles with fuel cells, which use hydrogen as an energy carrier, also have an electric motor. This is also known as an FCEV (fuel cell electric vehicle). Instead of drawing electricity from a battery, it is generated directly in the vehicle – a mobile mini power plant, if you will.

It is thus one building block among many for the mobility of the future. Overhead lines on highways are already being piloted, inductive charging in parking lots or at traffic lights is planned, and solar cells on vehicle roofs are also being tested.

Speaking of solar cells: Today, these generate up to 0.2 kW / m² under optimal conditions. However, the average consumption of electric cars is about 15 kWh / 100 km. So even if the entire roof of a vehicle (approx. 4.5 m²) were covered with solar cells, it would take more than a day in the sun to generate the electricity for a 100 km range. So photovoltaics can (and will) become a good complement. It is seen as another piece of the puzzle in the overall concept of electrified mobility.

This could be a hybrid of solar cell and BEV (battery electric vehicle) that charges itself inductively at traffic lights. Equally conceivable is a mixture of fuel cell with hydrogen tank and battery. But today’s plug-in hybrids also have a bright future with a larger battery. Trucks will possibly cover their power requirements for long distances with overhead lines above the highway, and the last 20 (or 100) kilometers on the highway will have to be covered by the built-in battery.

There will certainly also be new concepts and innovations that are still confined to the books of science fiction authors or are waiting tightly locked away in the R&D departments of major manufacturers or suppliers for the time to be ripe for them. The key to success here will be to achieve the right balance and appropriate combination of mature technology and innovative approaches. A full focus on just one direction will always be doomed to failure.

We are currently in the midst of the greatest upheaval in individual mobility since the introduction of the automobile. Everyone is talking about the automotive transition and new mobility offerings: E-scooters are one form of this.

There is uncertainty about the future role of e-scooters with regard to the new mobility. There is a split picture – while some see it as the savior for the last mile, others see it as just another failed attempt in the field of e-mobility.

E-scooters are designed for short-distance use and are intended to serve the first or last mile. They typically cover distances of between 500 m and 4 km – without the need to sweat or search for a parking space. The providers pursue a sharing principle in which the scooters can be rented for a fee (from unlocking: time and distance) via app and mobile payment.

Worldwide, e-scooters have been present in many cities since 2017. In Germany, however, the e-scooters were not approved until June 2019, but then changed the cityscape overnight.

The objective of e-scooters sounds thoroughly positive at first:

However, the problem is that e-scooters mostly replace pedestrian or bicycle traffic, instead of car or motorcycle traffic. This is bad for both the environment and health. The German Federal Environment Agency has evaluated the environmental friendliness and concluded that the scooters tend to bring disadvantages for the environment in inner cities where public transport is well developed. They also make bicycling or walking less attractive.

Another major problem is charging the scooters. The so-called “juicers” drive many kilometers in vans to collect the electric scooters, usually overnight.

Recently, a scandal broke out when resourceful students came up with a lucrative business idea: “juicers” as a side job. The scooters were charged overnight in the apartments of the University Center of the University of Cologne. The trick: the students only pay a flat rate for incidental costs, which is why the sharp rise in electricity costs caused such a stir at the student union.

Currently, the suppliers of e-scooters tend to burn money. The scooters currently have a service life of three months, whereas a break-even point is only reached at a service life of around four months. However, this does not take into account any marketing or overhead costs.

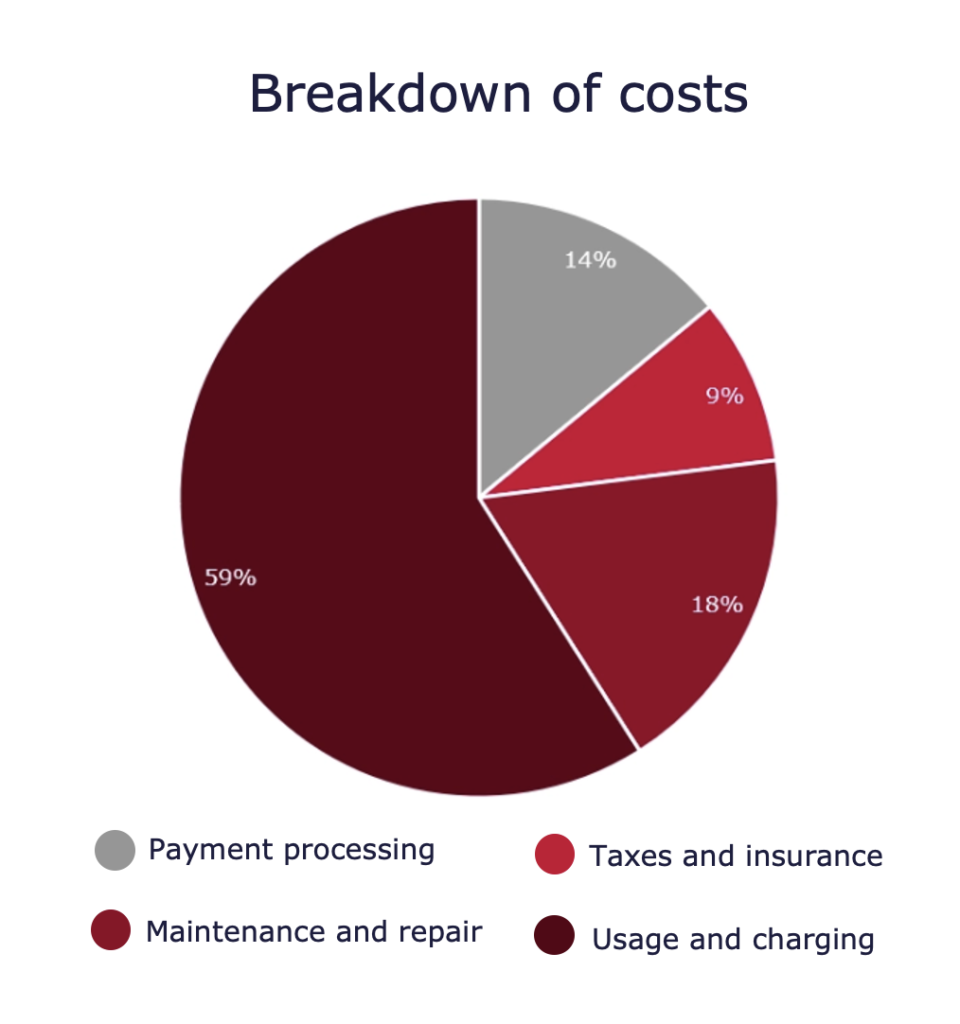

Looking at the cost side of the scooters, they can be grouped into four blocks:

It is noticeable that the highest costs are caused by charging.

“Juicers” have to go to great lengths to collect the scooters, plug them in overnight and deliver them again. To reduce costs, so-called crowd-charging models are also being tested, where users can take the scooter home to recharge it there.

Of course, vendors are trying to make further improvements to the hardware to reduce costs accordingly. Some providers are trying to develop their own hardware that has a longer lifespan. In addition, the providers are also planning to use exchange batteries.

| General facts | Markets supplied | Unique Features |

| Founded in 2017 in San Mateo, California (USA) | USA, Canada, Mexico, Australia, New Zealand, Singapore and nine European countries | Support by Google Maps |

| Approx. 700 employees (before Covid) | 15 German cities | Charging with renewable energy |

| 467 million dollars investment | ||

| 25,000 scooters in Germany | ||

| 1,065,000 downloads in the German Google Play Store from May 2018 – May 2020 |

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Berlin, Germany | 57 cities in 11 countries | Innovations such as foldable helmet and transport box |

| Approx. 470 employees (before Covid) | 39 German cities | Replaceable batteries in planning |

| $31 million investment | Climate-neutral operation from 2020 | |

| 18,000 scooters in Germany, 40,000 worldwide |

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Sweden | in the German cities: Aachen, Augsburg, Berlin, Bremen, Düsseldorf, Erfurt, Hamburg, Ingolstadt, Karlsruhe, Lübeck, Munich, Nuremberg, Potsdam and Stuttgart. | Replaceable battery |

| Approx. 500+ employees (before Covid) | 8 weitere, europäische Länder | Display that shows parking zones |

| $53 million investment | ||

| Several hundred scooters per city |

| General facts | Markets supplied | Unique Features |

| Founded in 2018 in Santa Monica, California (USA) | North America, Europe, Middle East | Longer durability of the scooters |

| Approx. 1,300 employees (before Corona) | 22 European and 5 German cities | High range thanks to strong battery |

| $415 million investment | 81 cities worldwide | |

| 100,000 scooters worldwide | ||

| 103,600 downloads in the German Google Play Store from May 2018 – May 2020 |

| General facts | Markets supplied | Unique Features |

| Founded 2018 in Berlin, Germany | Berlin, Cologne, Hamburg, Frankfurt, Munich | Design of 4-wheeled micromobiles for 2 persons |

| Approx. 100 employees (before Covid) | Austria, Italy, Spain, France, Belgium, Denmark, Portugal and Switzerland | Replaceable batteries in planning |

| 55+ million dollars investment | European expansion plans | |

| 20,000+ scooters across Europe | ||

| Bird subsidiary |

The low level of differentiation among suppliers leads to problems. Consumers generally simply opt for the scooter that is available next. It is questionable whether the diversity of providers will continue in the future. Providers will fight for individual cities. To do so, they will have to guarantee high availability and offer a larger operating radius. However, this will come at a price: lower utilization per e-scooter and thus higher costs.

It is very likely that the market will consolidate in the end and that only a few large providers will survive. It remains questionable whether regional providers will be able to stand up to large companies in individual cities.

E-scooter providers must continue to work on their business model in order to survive in the long term. The following steps are necessary for this:

Whether e-scooters will continue to shape the urban landscape to the current extent remains to be seen. What is certain is that the scooters can play an important role in urban transportation.

The Chinese electric car start-up NIO is aiming for this. In the future, the battery will be on the road as part of a “BaaS (Battery as a Service)” offering. The idea brings back memories of Renault’s concept for the Zoe. For this, NIO wants to establish its own company to manage the battery resources. An investment by leading Chinese car battery manufacturer CATL is also under discussion. Capital firms Guotai Junan Financial Products and Hubei Provincial Science and Technology Investment Group are also involved. All four companies want to invest around 25 million euros in the joint venture. So “battery banks” are to be created. The driver of an NIO e-car will thus be able to have his or her needs completely met: Instead of buying the battery, it will be rented. For example, a small battery pack is selected for trips in the city, and a large one for trips on vacation.

In China, the company benefits from an exemption rule for the subsidization of electric cars. This normally only applies to passenger car models up to a limit of 37,000 euros and would therefore no longer apply to most NIO models. However, vehicles with battery exchange systems are still supported by the Chinese government above this price. When buying an NIO, one decides not only on the model itself, but also on a charging model: The option of the exchangeable battery reduces the purchase price of the vehicle and a monthly battery rental fee is added. Swapping, on the other hand, is free of charge.

As the Chinese automaker reported back in the middle of the year, the company reached the milestone of half a million battery changes in China on May 25 with its NIO ES6 and ES8 SUV models – and that in two years. To that end, NIO now operates a network of 143 automated battery swap stations in China, where a robot removes empty storage and installs a fully charged one within minutes. A further 300 stations are planned for 2021.

In China, battery swap boxes offer a real alternative, as there is simply no space for large charging infrastructure in the megacities. The long distances in China are also a good area of application: for example, the G4, which connects the north with the south of China over a distance of 2300 kilometers: NIO set up its first pilot project there. One box took up the space of three parking spaces, took 18 hours to install, and has four batteries on hand that take an hour to charge. Battery demand is monitored in real time via mobile Internet. The technology is already in use in China. NIO plans to expand to other Asian countries and Europe in the future, but with a horizon of one to two years. By 2024, they want to be represented internationally.

However, this simple-sounding idea of “exchangeable batteries” still holds some challenges. The Better Place company drove a spectacular $850 million into the wall with a similar project in 2013. The battery-changing stations at the time were too expensive, too big and not yet technically mature. NIO has acquired many of the patents and now wants to implement this more cost-effectively.

It takes about 3.5 minutes to change the battery; including entry and exit, the job is done in around five minutes. In the vision, the vehicle already drives autonomously into the exchange box; in reality, it still has to park itself.

According to NIO’s CEO, William Li, the technology will work unlike Better Place’s for two different reasons: First, he says, it is significantly less expensive (about one-tenth of Better Place’s boxes) and second, it is much more technically advanced. For example, automatic lifting platforms are installed in the boxes, making it easier for the changing robot to place and mount the battery with millimeter precision. Nevertheless, problems remain: The costs are still quite high, technical errors occur, and the boxes are currently still maintained by humans, so they do not yet work fully automatically. Interchangeable batteries are one possible solution to the range problem. But so is a well-developed fast-charging infrastructure. The perfect solution is probably a mixture – as NIO is striving for.

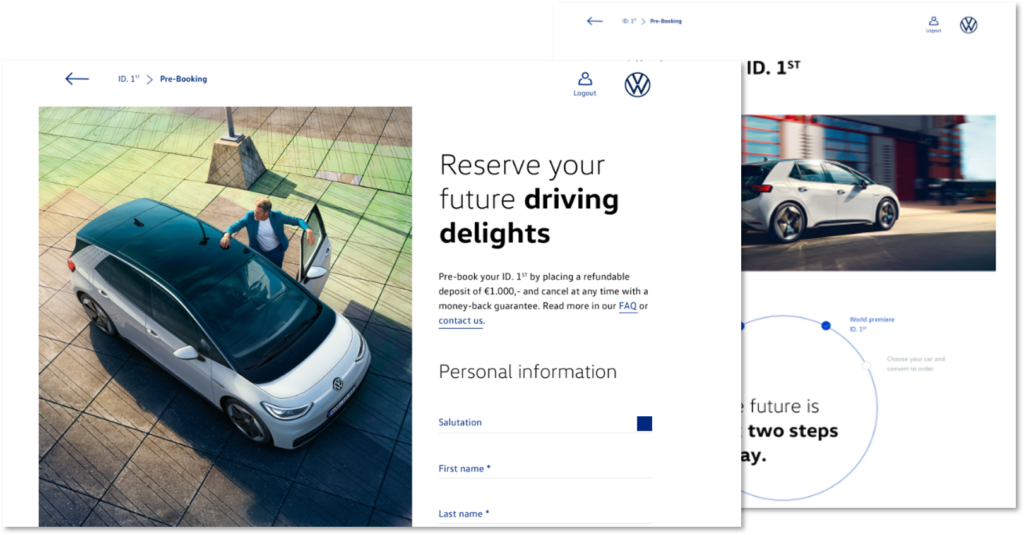

Our IT experts develop an e-commerce tool for you to pre-reserve an e-series vehicle, as well as for rollout coordination in 21 markets. We take care of both the frontend and the backend and implement both a newsletter route and showroom streaming to increase the conversion rate.

Scope: 400 person-days (PD)*.

* PD = Person days à 8 hours

The current trend toward agilization is unbroken. For managers in particular, it is important to know when the use of agile working methods makes sense and when it does not. Of decisive relevance is the correct application of the various agile process models.

For this purpose, we at Consileon have developed an agility training specifically for managers. In our two-day training you will learn:

Learn more about training in our brochure. (The brochure is in German.)

As an experienced IT consultancy, we manage the content creation process of e-mobility content on your website. We optimize existing content as part of the transition to the New Brand Design .

Scope: 120 person-days (PD)*.

* PD = Person days à 8 Stunden

We guide you through the conception, development and roll-out of an online sales channel for the Charge & Fuel Card in a reliable manner. In doing so, we also pay attention to the charging providers and are committed to seamless coordination and cooperation. In addition, we develop a service and support concept to guide your customers appropriately through the purchase of a Charge & Fuel Card. Finally, we conduct a competitive analysis to optimize the business model.

Scope: 350 person days (PD*)

* PD = Person days à 8 hours