For the seventh time in a row, Consileon has managed to be named Beste Berater in the brand eins and Statista rankings. Since 2015, we have managed to be among Germany’s top consultancies thanks to positive reviews from clients and recommendations from colleagues.

The evaluation by the statistics portal Statista and the business magazine brand eins surveyed more than 8,000 partners and principals (of whom 2,334 completed the questionnaire) as well as 234 senior executives from DAX-listed companies and 1,100 from other companies. The management consultants themselves had to indicate which colleagues they would recommend, although self-referrals were of course excluded. The customers surveyed then assessed the consulting firms on the basis of their own experience.

A total of 307 companies and 7 consultant networks emerged from these two surveys that can call themselves Best Consultants 2021. These come from a total of 16 industries and 18 fields of work.

In addition to Consileon, syracom AG and ajco solutions GmbH, both members of the Consileon-Gruppe, won the coveted award for the second time.

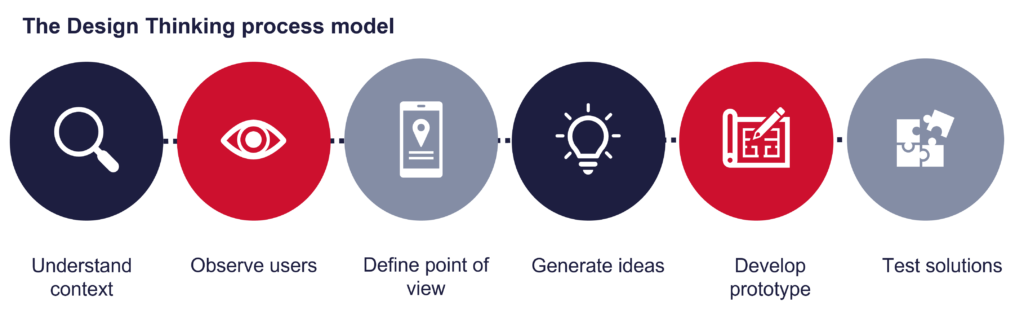

Design thinking is an agile approach to innovation that is used to develop concepts for new products as well as processes or services. Especially in the global Corona crisis, Design Thinking is more in demand than ever, because you use it exactly when you want to create innovations, but do not yet know exactly which ones. Almost all companies are struggling with such uncertainties at the moment, and those that master the challenges faster and better get through the crisis better. To ensure acceptance and benefit of the developed solution, users of the final product are involved in the development process from the very beginning. Cost efficiency and viable solutions are achieved with this approach by testing the results at an early stage using prototypes and optimizing on the basis of these results.

Design thinking uses an iterative process model whose phases are run through again and again until a validated solution concept is established. With the help of a variety of empathy, creative and prototyping techniques, the focus is always consistently on the needs of the end customer.

Our flyer on the subject provides you with further information.

(*The flyer is only available in German.)

The factors of digitization, artificial intelligence and the platform economy have also led to the market entry of technically oriented start-ups (FinTechs) in the asset management industry, which are attempting to gain market share with new approaches. As a result, the business models of Kapitalverwaltungsgesellschaften (= KVG, engl.capital management companies) are under attack, particularly in product development and asset/portfolio management, as well as in the sales model. Particularly in the emerging ETF segment, it is about 12% market share that the FinTechs are contesting with the capital managers. Consileon’s newly developed FinTech radar can be used to evaluate the new market players in order to identify emerging players within asset management at an early stage.

FinTechs and providers of wealth management services and social trading platforms often differ only slightly, are highly competitive with each other, and exhibit a high degree of dynamism in their corporate development. On the part of the KVG, it is crucial to expand the potential for cooperation (this applies to infrastructure and organization) in order to leverage the innovative strength of FinTechs within the value chain in a spirit of partnership instead of merely classifying them as competitors.

Our thesis is that the KVGs will continue to specialize and at the same time build up the flexibility to network in cooperations and platforms.

We will be happy to send you the complete study upon request. Register here. (*The study is only available in German)

In our study, which is cited several times in a detailed article in the Handelsblatt of January 18, 2021, we show you why AI in particular can revolutionize banks‘ efforts to combat money laundering in the future.

The problem is more topical, the criminal energy more creative than ever: money laundering scandals have recently rocked quite a few banks in Europe and in this country. As a result of globalization and digitalization, financial institutions are facing increasingly complex fraud schemes – with far-reaching consequences in terms of fines and reputational damage. Banks have a duty to prevent money laundering and are required to take targeted action to counter the abuse of the financial system. However, they face many different challenges in doing so:

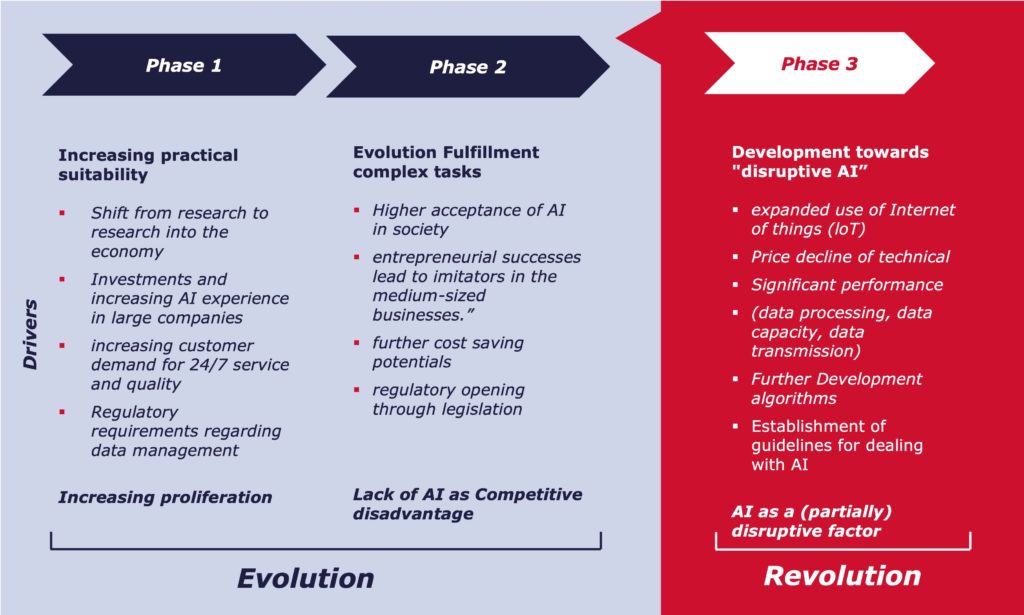

In particular, we see enormous potential for generating important competitive advantages in the further accelerating digital transformation as well as in the implementation of novel key technologies such as artificial intelligence (AI). In order to be able to make concrete statements about the actual performance capacity for combating money laundering from a temporal and functional perspective, despite the fast-moving and dynamic development in the topic of AI, Consileon has developed a future-oriented, three-stage phase model.

The asset management industry is constantly facing new challenges. With existing regulatory and cost pressures, customers have clear return expectations of asset managers, even in volatile market phases. Customer solutions should be as individual as possible, but sustainability preferences are also at the forefront for many, with the demand for transparent information at all investment levels.

Another focus is on modularizing and optimizing asset managers’ value chains. Target Operating Models (TOM) must be adapted and developed to changing market conditions and technical progress. In addition, the cost situation must be broken down to the product level to introduce effective measures for an improved cost-income ratio.

Digitization and using AI as the final focus are essential support and information tools in this context. In addition to an optional digital offer page, the digitization of product life cycle management in an end-to-end view is a central topic. The tokenization of assets is also becoming increasingly important – up to and including the complete relocation of the custody chain to the blockchain.

All key topics require expert knowledge supported by adequate change management tools.

Talk to our experts, who will gladly share their process, project, and product knowledge.

In times of optimization of value chains, asset managers are increasingly faced with a make-or-buy decision in relation to individual process steps within the value chain. Optimization potential can be leveraged through digitization or cooperation with FinTechs.

On the one hand, asset managers are currently experiencing gratifyingly high inflows of funds; on the other hand, however, they are also faced with steadily growing customer requirements and new regulatory requirements. In addition, in the current low-interest phase, investors are increasingly seeking diversification into alternative asset classes, among other things. This often pushes processes and the IT infrastructure to their limits and many manual workarounds are established, which have a negative impact on efficiency (STP level) and quality (errors and claims).

Under these conditions, we recommend analyzing your company’s performance in detail and reviewing existing processes. The operating model approach (OM approach) developed by Consileon is suitable for this purpose. It can be used to define and control the E2Eprocess routes for services and products. By structuring the value chain into core processes to which employees, systems and costs are assigned, it is possible to determine how costly the creation of a product or service really is over several steps. The result is a system that enables you to make unit costs and absolute costs transparent for all products and services of the OM.

Mit dieser Information können Sie entschieden, ob sich z.B. eine Digitalisierung von Prozessschritten durch Systemerweiterungen lohnt oder ein Fremdbezug der Leistung effizienter wäre. Gleichzeitig können Sie erkennen, in welchen Services Potenzial für ein Insourcing liegt, da Sie diese im Vergleich zum Markt deutlich günstiger produzieren können.

We are happy to help you introduce an operating model structure into your internal controlling and advise you on the strategic options that arise from the newly created transparency.

Talk to our experts about this.

The Mandate Administration Portal (map) offers a comprehensive solution for digitizing contract administration in the complex fund mandate environment. All events affecting the fund mandate are mapped with their relevant contract requirements (e.g. new issue, change of asset manager, changes). Processing takes place via an end-to-end approach with dynamic workflows and responsibilities per activity.

Extensive information on map can be found on the homepage https://www.congentics.de/

For many years, Consileon has assisted asset managers and banks in Germany, Luxembourg, Austria, Switzerland, the Netherlands and Sweden in the procedural, technical and sales implementation of regulatory requirements.

Talk to our experts about efficient and effective ways of implementing current requirements.

Consileon experts have supported clients in a variety of regulatory processes in terms of planning, execution and implementation. In the process, they have successfully supported projects in licensing and approval procedures, the introduction of new legislation such as KAGB, MiFID II and ESA stress tests. In the Regulatory Expert Group, specialists also deal with the topic of sustainable finance .

The digitization of product life cycle management is one of the driving topics in asset management. Internal processes must be digitized for efficiency reasons and workflows optimized in order to withstand international competitive pressure. With the Consileon subsidiary Congentics, the innovative application “map” was created, which supports data management, the onboarding or life cycle management process and contract reconciliation completely digitally.

For more information click here.