Optimize payment for online services in the car

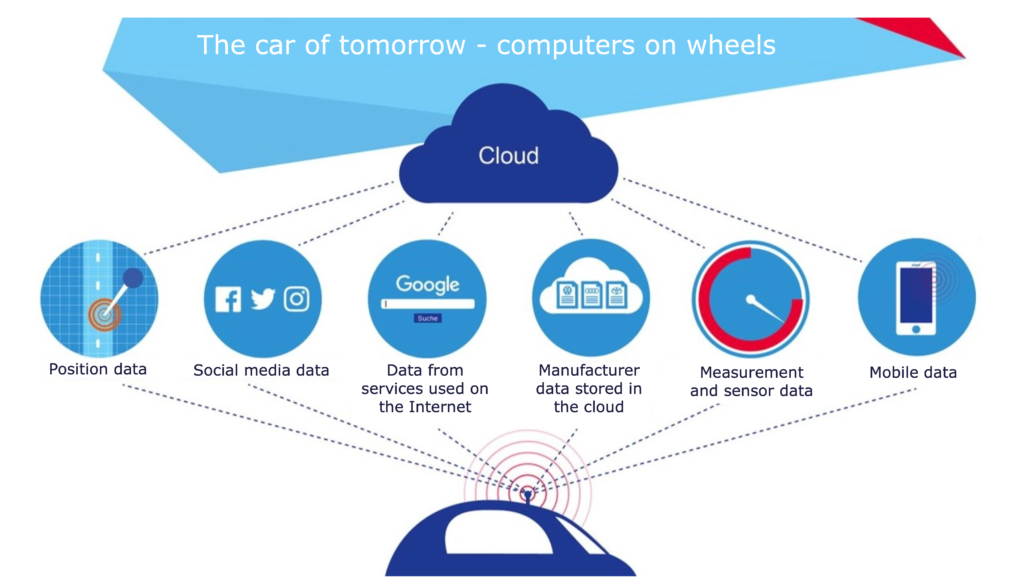

In the automotive industry, too, business success is increasingly measured by the “smartness” of products, i.e., criteria such as networking, learning capability and automation. The smart car or connected car is integrated into a holistic mobility concept. Via the on-board system or smartphone, it offers online services, some of which are chargeable, including a payment function. How such transfers are handled technically is crucial to the success of such mobility concepts and services.

Explosive market growth

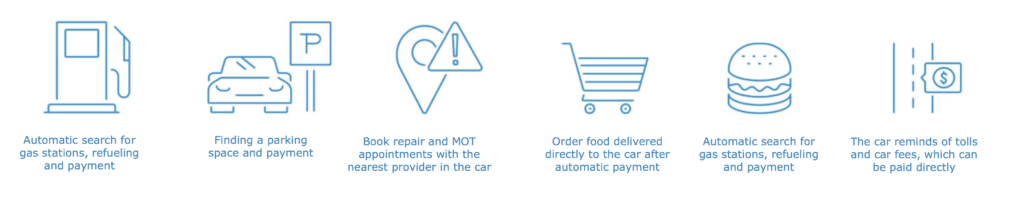

In 2020, connected cars will have exceeded a market capitalization of 200 million euros. Analysts expect this volume to rise rapidly to 530 billion euros by 2030. Almost all manufacturers and suppliers are researching smart vehicles or helping to develop them. In-car payment plays a key role in this. Examples of mobile online services in the connected car:

Before realization, the following questions, among others, must be clarified.

- Which wireless technology do we use to transmit which data? NFC, long-range RFID, Bluetooth Low Energy (BLE)?

- Which payment platform do we use?

- How do we make the payment process as convenient and secure as possible?

- What technical means do we use to fend off fraud attempts?

Internal versus external solution

From an organizational perspective, automakers must decide whether they want to offer mobile payment internally, externally, or according to a hybrid model. Those who outsource in-car payment completely compromise on flexibility and speed of innovation. Most payment service providers (PSPs) develop one-size-fits-all solutions that cannot be tailored to customers’ business models. If technical or regulatory innovations are pending, the customer must be patient until the PSP reacts.

In order to remain flexible and system-independent, car manufacturers must process and manage payment transactions on board themselves (in-house approach). The high upfront costs pay off at the latest when the business model expands. Those who opt for an in-house solution acquire know-how and determine the course themselves. And if all else fails, an external expert (payment manager) can be recruited or consulted.

Hybrid model

Because of the expensive upfront costs and fixed personnel costs, in-house processing of in Payment-Orchestration (PO) offers a middle ground between in-house and outsourcing. At its heart is an open IT platform that brings together payment channels, modules, competing PSPs, banks and other service providers. Providers of goods or web services work on it selectively with partners of their choice, tailor the payment modes to the target groups, spread the default risk, and implement innovations much faster than a single PSP would do for them.

Payment-Orchestration also pays off in medium-sized companies. As a payment specialist, aye4fin, part of the Consileon group, helps with the planning, implementation and further development of in-car solutions as well as with the optimization of payment for mobile online services and the development of business models in regulated industries.

Core competencies of aye4fin:

- Payment-Orchestration

- Digital platforms

- Payment-Audit

- Implementation

- Optimization

- Multichannel payment