Only in a few car dealerships do the digital touchpoints exploit the potential of the technology. Although they offer attractively presented information, they lack the element of surprise. Neither can the interaction be continued from one touchpoint to the next, nor can the prospective customer’s mobile device be integrated into the buying experience. Interaction data recorded by the isolated applications cannot be individually assigned to the potential car buyer. The customer journey is therefore hardly measurable, and subsequent consolidation of the data is costly.

Anyone entering a car dealership today has usually already spent some time researching suitable models on manufacturer websites, comparison portals, Instagram or Facebook. A networked digital showroom offers prospective customers the opportunity to bring the information they have obtained in advance with them on their mobile device and to link it to the digital media on site. In this way, the research continues seamlessly – an added value for both sides, because the dealer can thus better respond to the customer’s wishes.

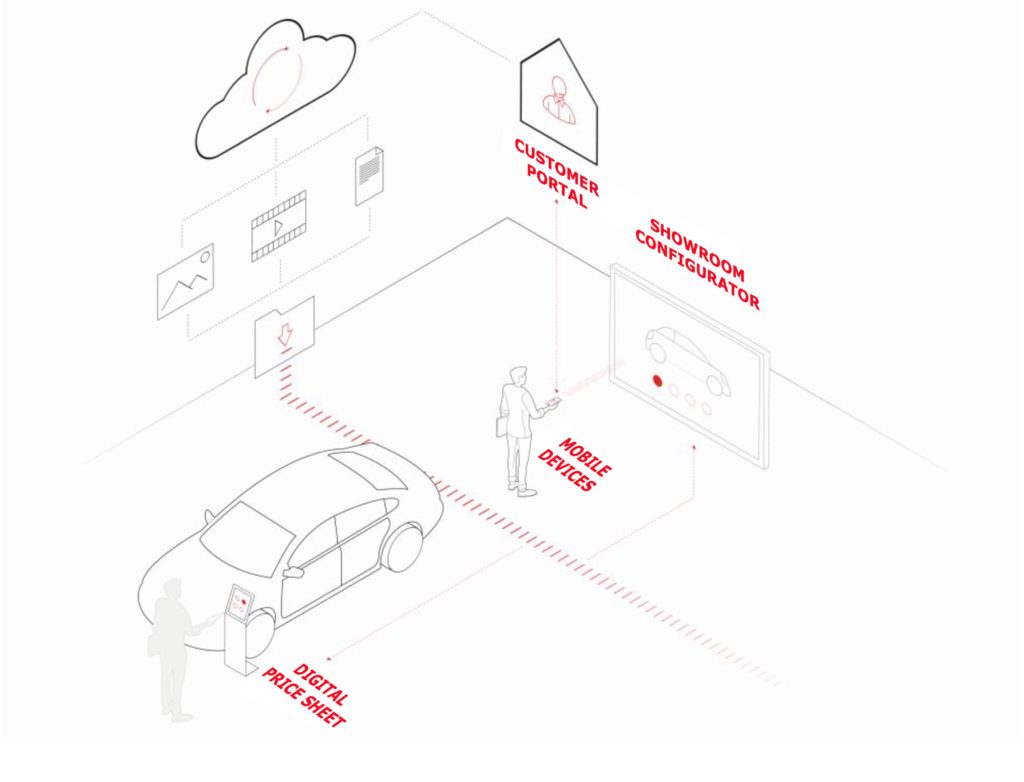

For the holistic optimization of the digital showroom, Consileon has developed the “One Backbone” approach in an overall concept in cooperation with a partner. The customer experiences a selection process without media breaks, which the car dealership can capture with little effort. One Backbone connects the digital elements of the showroom. Car dealers can upload up-to-date data via this network, which can then be accessed immediately at all touchpoints. The potential car buyer’s interaction with the digital information offerings is recorded and collected centrally on site. In this way, the content retrieved by the customer can be passed on from one touchpoint to the next or to the smartphone as the customer makes his way through the showroom.

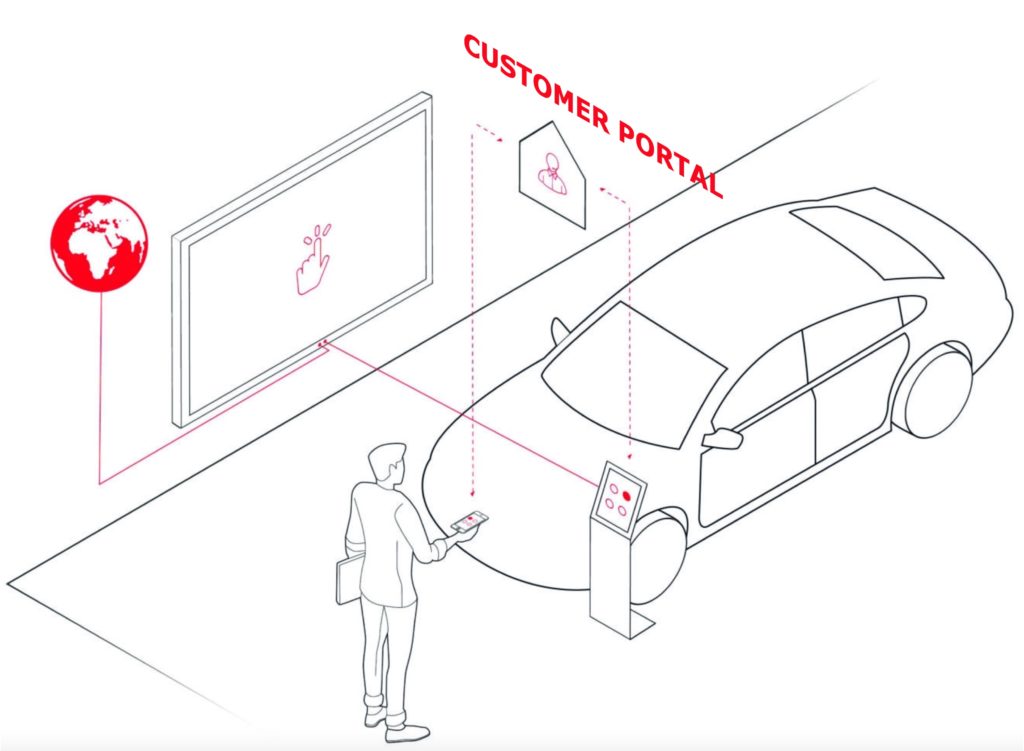

Our digital vehicle displays can be equipped with additional, optional Content-to-Go via the customer’s smartphone. Here, supplementary content can be loaded onto the touchpoints via a link to the customer portal to which he has logged in.

You can find a lot of information online on our Connected Digital Showroom microsite.

(*only available in German)

The holistic view counts: A variety of transformation drivers lead to changes that must not only be implemented and designed in the process organizations, but for which, above all, the employees must be successfully brought along. During significant changes, people go through different phases of an emotional process. That is why their targeted support and motivation are particularly important success factors for us: The will to shape and change must be encouraged, and sometimes worries or fears must be allayed. Our consultants accompany your employees as well as group dynamic change processes from the very beginning and adapt the change design we have developed according to the situation. Openness to change: Communication plays an elementary role for us to create transparency, to dissolve any resistance, to drive processes and integration. We make complex and dynamic transformation projects comprehensible and transparent. Through active participation, we ensure broad acceptance and joint identification.

What does change actually have to do with us as a consulting firm? A lot – or rather everything! Because only those who remain open to new things, constantly question themselves as consultants and reflect on their own actions can drive change and initiate creative solutions.

Our systemic approach helps us to perceive and shape dynamic processes. We create space for trust, for participation and provide orientation for alternative solution options. In doing so, our view is always appreciative and solution-oriented. Learning never stops for us and shapes our corporate culture: For Consileon, the focus is not only on individual learning, but on learning from each other. Through reflection work, we become more aware of our own abilities and can use them in a more goal-oriented way. We train our consultants both internally and externally. We are not primarily concerned with obtaining certificates and degrees. The focus is rather on the concrete application and (experience) of an agile and systemic way of thinking and acting. We see this as a clear added value for our customers.

If you want to actively tackle change, you need new ways of thinking and innovative tools. In an extremely dynamic and complex environment, mechanistic methods and traditional ways of working according to sequential linear steps towards a predefined solution no longer work. Effective approaches and tools like these have long been our method:

Learn more in our brochure on Change Management and Agile Transformation. (*only available in German)

We help you turn legislation into innovative services. Take the Central Securities Depository Regulation (CSD Regulation), for example. What does this have to do with you? More than you might think: Anyone who trades securities will have to deal with the regulation, and the rules differ depending on the type of security and the trading venue. A central securities depository (CSD) is an entity that stores financial instruments such as stocks or bonds for holders or their banks, respectively, and provides ancillary services. If a seller defaults on a transaction with a CSD, he or she will also be subject to sanctions in the future if the transaction is not conducted via a central counterparty (CCP), such as a clearing house. In addition, market participants from the EU must appoint a neutral buy-in agent as an alternative supplier of the security in the event of default. Participants working with an external buy-in service comply with this legal obligation and mitigate any penalties.

Do you operate a global depository with a large network of depositories? Then you could also act as a buy-in agent for the traders and brokers among your clients.

Consileon combines industry knowledge with change management expertise. In order to hold one’s own on the market, it is not enough to awaken latent needs via digital marketing. Design thinking experts develop digital products the way the target groups want them.

Together with your team, we formulate use cases that you can coordinate with customers and business partners of your market platform. Using an agile approach, we quickly determine how product ideas are received by the target groups, so that you only develop the best ideas to market maturity and avoid expensive bad investments. To accomplish all this, Consileon’s capital market experts and accomplished change managers work hand in hand.

“Design is not just how it looks and feels. Design is how it works.”

Steve Jobs (co-founder Apple)

The theory of constraints assumes that there is always exactly one bottleneck in a company that determines the performance of the whole. It is therefore essentially a matter of identifying this bottleneck and, if possible, eliminating it.

Below you will find an exemplary roadmap for the implementation of portfolio optimisation by means of bottleneck management.

With industry knowledge, analytical strength, strategic thinking and innovative power, we help companies in the insurance industry to master the challenges of a market in transition.

Together with our clients, we develop sustainable solutions for all links in the value chain: from product development to marketing, sales and risk management to IT. To deliver an immediately usable result, we provide you with consulting, software and project work from a single source.

Our core competencies include consulting on sales topics. One focus is the optimisation of processes and IT systems for the cooperation of insurers with their sales partners. Here, the following tasks, among others, have to be solved:

The insurance market is largely saturated. Customers are becoming more critical. Before signing a contract, many inform themselves via comparison portals or on interaction platforms (social media) on the internet. In addition, providers of substitute products such as bank or fund savings plans are increasing the competitive pressure.

Demographic change and changes in the preferences of potential policyholders require a revision of product policy and distribution. Offers must be reviewed in terms of their benefits for the customer, differentiated and repositioned. For example, instead of a rigid tariff scale, consumers today would rather have a modular system of basic and additional modules from which they can individually compile their insurance cover.

Direct sales via the Internet are gaining in importance, especially in the business with standardised services such as supplementary health, liability or property insurance. But products requiring advice can also be marketed online – for example by means of cobrowsing or chat functions on the provider’s website. Younger customers in particular also expect to be able to carry out simple actions such as reporting a claim via a mobile device.

Sales through banks, brokers and financial product distributors continue to increase at the expense of exclusivity. In order to leverage synergies and boost sales, it is necessary to develop an overarching marketing strategy including sales management, to network the sales channels and to support the sales partners according to their value contribution. This includes the introduction of a remuneration model that avoids conflicts between sales targets, advisory quality and compliance.

Opportunity and risk are the two sides of the same coin. If you want to make profits, you have to invest. And in doing so, you automatically take risks. However, the occurrence of excessive risks can not only ruin entire companies, but escalate into a systemic crisis. The accumulation of such crises prompts legislators to intervene.

Due to the still lingering crisis of 2008, the financial industry has been under regulatory pressure for years, especially in the USA and Europe. This particularly affects risk management. There is no end in sight. The relevant legal standards have an impact at both strategic and operational levels. Their influence extends from the business model to organization, functions, processes and methods, right through to technology and corporate culture.

Whether setting up, expanding or restructuring risk management, whether a detailed issue or a major project: financial institutions that want to keep risks under control in line with regulatory requirements find a competent, pragmatic partner in Consileon. We help our clients not to be overwhelmed by the regulatory tsunami, but to surf ahead of the wave, always towards success. Especially in risk management, it is important that all hands interlock. Partial aspects can be tackled individually, but the results must be coordinated and integrated into the big picture. This makes risk management a task that is as exciting as it is comprehensive. Among the factors on the radar of the supervisory authorities are the following:

Our interdisciplinary teams of consultants help financial intermediaries analyze and map the above factors in line with regulatory requirements. In addition to financial risks, our project practice covers other risk types including risks in cross-cutting functions, including:

Are you looking for a loyal partner who can provide you with advice and support for risk management initiatives? Then we look forward to receiving your inquiry.

The business of asset managers has changed dramatically over the past ten years. Only the respective market leaders benefit from the triumph of passive products. The clients of active asset managers are becoming more demanding, the sales structures more complex.

The financial crisis is also a crisis of assets under management. In the coming years, asset management and its distributors must demonstrate that their products deserve the trust of investors. To do this, they need to position themselves clearly in the market: either through exposure to liquid markets at a low price (cheap beta) or with high value contributions through active management (expensive alpha). In both models, market success stands and falls with the quality of the support provided to clients and distribution partners. For asset managers, this results in an extensive agenda. In addition to products, distribution partnerships are being put to the test and new sales channels are being opened up. Investors have access to information around the clock, and complementary services such as risk management are increasingly being marketed as stand-alone services. In Consileon, asset managers find a competent partner who sees change as an opportunity. We advise our clients on topics such as:

In anticipation of persistently low interest rates and rising inflation, professional management of their assets is becoming more important to investors. To benefit from this trend, providers must convince with attractive products, first-class service and sustainably low costs. Consileon supports them in this with:

The optimization of business processes requires a critical inventory of the system landscape. As an experienced partner, Consileon supports asset managers in modernizing their IT with the following services, among others:

In den letzten zehn Jahren hat Consileon acht Kundenbindungsprogramme maßgeblich mitkonzipiert, weiterentwickelt und betreut, davon sieben allein in den letzten drei Jahren. So unterschiedlich die hierbei betreuten Kunden sind, so unterschiedlich sind auch diese Kundenbindungsprogramme: stand-alone oder partner-übergreifend, mit Anmeldung oder anonym, mit oder ohne Karte, online, mobile oder papiergebunden.

Meine Übersetzung

So leisteten wir im letzten Jahr für unsere Kunden über 1.200 fachliche und über 2.300 technische Beratertage in 30 Handelsprojekten, betreuten dabei insbesondere 15 Kernsysteme unserer Kunden.

Die hierbei angepassten bzw. neu konzipierten Systeme realisierten hierbei bis zu 3.000 Handelskampagnen p.a., verarbeiteten bis zu 630 Mio. Bons p.a. von bis zu 46 Mio. Loyalty-Kunden, prüften und lösten hierbei bis zu 4 Mio. Coupons am Tag ein, kommunizierten real-time mit bis zu 30.000 Kassen und 7.000 Service-Terminals in 7.000 Märkten bzw. bedienten bis zu 100.000 aktive Online-Kunden am Tag, dabei wurden Verarbeitungszeiten von kassenbedingten Transaktionen von unter 58 ms in 98 % der Fälle erreicht.

So unterschiedlich die Systeme sind, so unterschiedlich sind die eingesetzten Technologien: JAVA, .NET/C#, MS Dynamics AX, JS, Angular, SAS (CI, MOM, RTDM), SAP, OSIS, ARC, MQS, Kafka, Hadoop (Cloudera, MapR), APM, Azure DB, IBM DB/2, MS SQL Server, Oracle, Teradata, BigData, AzureCloud, GoogleCloud, SpringBoot, Windows 7, Windows 10, Solaris, LINUX, AIX, MVS, SpringAOP,…