D7 is an enabler for straight through processing, smart lifecycle management and intraday issuance. Through connection to the golden source of data, reconciliation efforts do no longer occur. Integrated processes, and data provisioning to other stakeholders, ensure a close to real-time data distribution.

What is D7?

D7 is a digital alternative to the traditional physical issuance and processing of securities. With the help of the D7 platform, it is possible to issue electronic securities by market participants using the digital instrument (DI), a digital description mapping of the securities in a database and thereby drive the digital transformation of the financial industry.

Issuing banks can digitize their financial products and have access to existing centralized and decentralized infrastructures and markets. In the issuance, custody, settlement and asset servicing of electronic securities, market participants benefit from same-day issuance and automated straight-through processing. Other benefits of D7 technology include:

- Reduced costs due to paperless automated processes

- Full transparency and smart lifecycle management

- Continuous availability (24 hours / day from Monday to Friday)

- Fewer data inconsistencies due to direct access to the golden source

- Less media discontinuity and need for coordination due to the automated standard

- Reduced reconciliation effort

- Faster issuance and larger volume of structured products can be issued

- Compatibility with existing systems

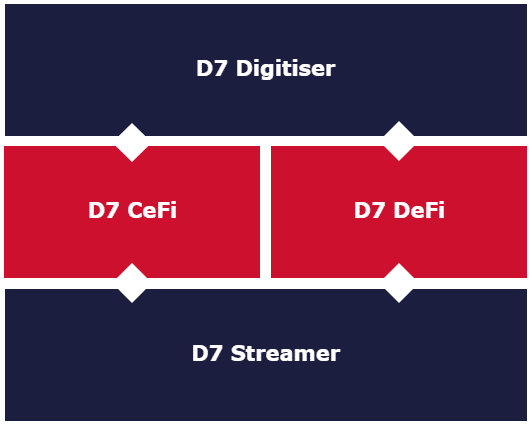

To enable the issuance and trading of electronic securities, the central register (D7 CeFi), which is based on the eWpG (electronic Securities Act), is an essential part of the D7 infrastructure. The central register and the depository register implement section 12 of the eWpG. The central register mainly contains the master data of the issued securities, and it offers the possibility to view the terms and conditions of the contract. In addition, it maps the entire life cycle of the electronic security, in particular its value date, maturity date and other corporate action events. The D7 Digitiser uses the established payment systems for settlement. The D7 Streamer aims to automatically distribute the relevant data to the connected market participants to enable efficiency gains. In the future, D7 aims to implement Section 16 of the eWpG (crypto securities register) and to expand its offering internationally based on the relevant regulations, and to extend to decentralized networks (D7 DeFi).

How are banks connected to the platform?

The connection to D7 Digitiser is possible via a Graphical User Interface (GUI) and from July 2023 onwards via a dedicated Application Programming Interface (API). The GUI can be used for manual upload or as a backup of the processing. The GUI is web-based and exposed to the internet.

The API can be used for machine-to-machine (M2M) connections to enable bulk issuance and to send the XML and terms and conditions at ISIN level (eWpG). It is hosted and operated by Deutsche Börse. The technical documentation specification is also stored on Deutsche Börse Digital Business Platform.

Consileon’s success factors

Some of Consileon’s key tasks to support our customers in the connection to D7 are the following:

- Analysis and implementation of adjustments to the issuance process to the bank’s internal and external systems (e.g., providing the correct values for WM for dematerialized securities)

- Analysis and implementation of the adjustments to the internal issuance and settlement system resulting from the changes to the SWIFT messages

- Implementation of the changes to automatically create the required formats for the issuance of electronic securities

- Programming of the interface (API connection) to D7

- Internal setup of the access authorizations for authentication for issuance into D7

- Analysis and implementation of the adjustments in the processing of lifecycle events

Consileon has supported Deutsche Börse Group in the realization of the D7 platform from conception to implementation. This is exactly in line with Consileon’s belief to stand by its customers throughout the entire process, from vision to concrete development. Thus, Consileon has deep insights into the architecture of the platform and represents a fitting partner to connect banks to D7. Consileon is familiar with the characteristics of the connection and can therefore implement the project in a linear and cost-efficient manner in the interests of its customers. Issuing banks that also want to be part of the digital transformation will find Consileon as a competent partner with experienced technology consultants. Thanks to many years of experience in the capital markets sector, our consultants provide their expertise and take a holistic view of the bank’s infrastructure, so that they can accompany an implementation tailored to your needs.

Consileon ranks with over 500 consultants among Germany’s largest and fastest-growing midsize management and IT consulting companies. Clients include global and regional businesses from various industries as well as public sector organizations. Consileon implements customer-oriented solutions that set the highest standards in terms of accuracy, usability, reliability and quality.