The introduction of scaled agility is a lengthy change process with quite a few pitfalls and stumbling blocks.

At Consileon , we have been able to build up both the methodological competence and practical experience and expertise in this area over the years with various customers. As IT experts, we do not try to introduce agility for agility’s sake, but decide on a situational basis where agility is beneficial and where it is not.

We look at the task with a holistic and systemic view. We not only develop the strategy for introducing scaled agility, but also accompany the client during the corresponding implementation and adapt the change design according to the situation. In doing so, our consultants encourage their employees’ will to shape and change, but also address their concerns and worries.

Openness and transparency are the foundations of our consulting activities in order to make complex transformation projects understandable and comprehensible. In this way, we create broad acceptance and identification with the change process in your company through the active participation of your workforce.

The action control model according to Prof. Dr. Julius Kuhl assumes that four different brain areas perform different tasks. These can be significantly controlled by emotions and thus have a great influence on people’s behavior.

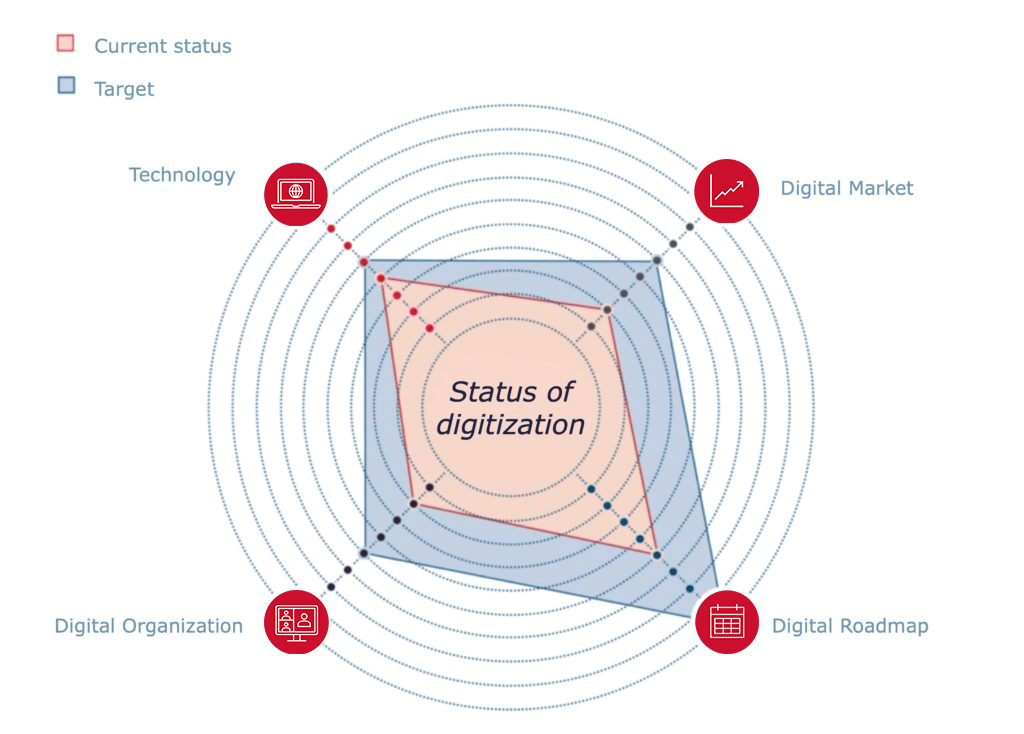

We are digitization experts with an extensive track record in implementing digitization projects. We know the requirements, needs, culture and special capabilities of SMEs and have aligned our approach to digital due diligence accordingly.

We tailor digital due diligence to your company. Depending on the business model and value chain, we set different priorities along the four dimensions.

The goal is a reliable assessment of the economic opportunities and risks as well as the organizational and technical pitfalls of your digital project.

For the sixth time in a row, Consileon has managed to be named Beste Berater in the brand eins and Statista rankings. Since 2015, we have managed to be among Germany’s top consultancies thanks to positive reviews from clients and recommendations from colleagues.

The evaluation by the statistics portal Statista and the business magazine brand eins surveyed more than 2,000 partners and principals as well as 230 senior executives from DAX-listed companies. Thus, the management consultants themselves had to indicate which colleagues they would recommend, whereby self-nominations were of course excluded. The clients surveyed then rated the consulting firms on the basis of their own experience.

A total of 309 companies and eight consultant networks emerged from these two surveys that can call themselves Best Consultants 2020. These come from a total of 16 industries and 18 fields of work.

In addition to Consileon, syracom AG and ajco solutions GmbH , both members of the Consileon-Gruppe , won the coveted award, also for the second time.

Business with affluent customers appears to many banks to be a safe haven in the storm of market developments: steady portfolio income, low dependence on deposit income, and loyal customers who – according to popular opinion – do not have particularly high expectations of digitization. From our perspective, this perception is wrong. Worse still, while it has long been clear to all market participants in the broad private customer business that there is an urgent need for change, there is a deceptive calm in wealth management. While leading providers are consistently working on issues such as integrating technology into advisory processes or aligning investment strategy with sustainability, many other private banks have not yet sufficiently addressed the challenges ahead. To this end, fintechs are showing that classic private bank topics such as asset management can be offered in a way that is both visually appealing and efficient. The more such approaches become the norm, the more those that do not modernize will be left behind.

All in all, wealth management is subject to considerable pressure to change! The key here is to assess market developments and act quickly. Below you will find a selection of core trends that we have identified for you.

From digital lead generation and onboarding to self-advice, execution, and reporting, digital channels will be present in 2025, supporting branding, generating prospects, and easing the burden on relationship managers. Reason enough to subject your wealth management to our digital readiness check!

Advice has its price. Currently, however, not every customer pays for investment advice. In our view, this is an untenable situation. This is why successful providers are now setting the course for new service models – especially in the securities business. Take advantage of our expertise in product and pricing design as well as in sales transformation.

Our SAFe® Program Consultants (SPC) Agnese Tucci, Johannes Manuel and Wieland Voss inspired the participants of the training “Leading SAFe® 5.0”, which took place on February 24 and 25 in our office in Frankfurt.

In this training, participants were able to interactively build and deepen important expertise in the Scaled Agile Framework (SAFe®). We are already looking forward to many more SAFe® trainings that we will host in the future as an official Scaled Agile Partner Silver.