Several years behind European neighbors such as Denmark, Sweden and the Netherlands, mobile payments have now also arrived in Germany. Driven by the large, mostly American card companies and tech groups, retailers, banks and network operators have upgraded the payment infrastructure and developed processes that are gaining acceptance among the public. At the beginning of 2018, only one in five people made contactless payments by bank card, credit card, smartphone or smartwatch; according to a Postbank study, this figure rose to one third within a year.

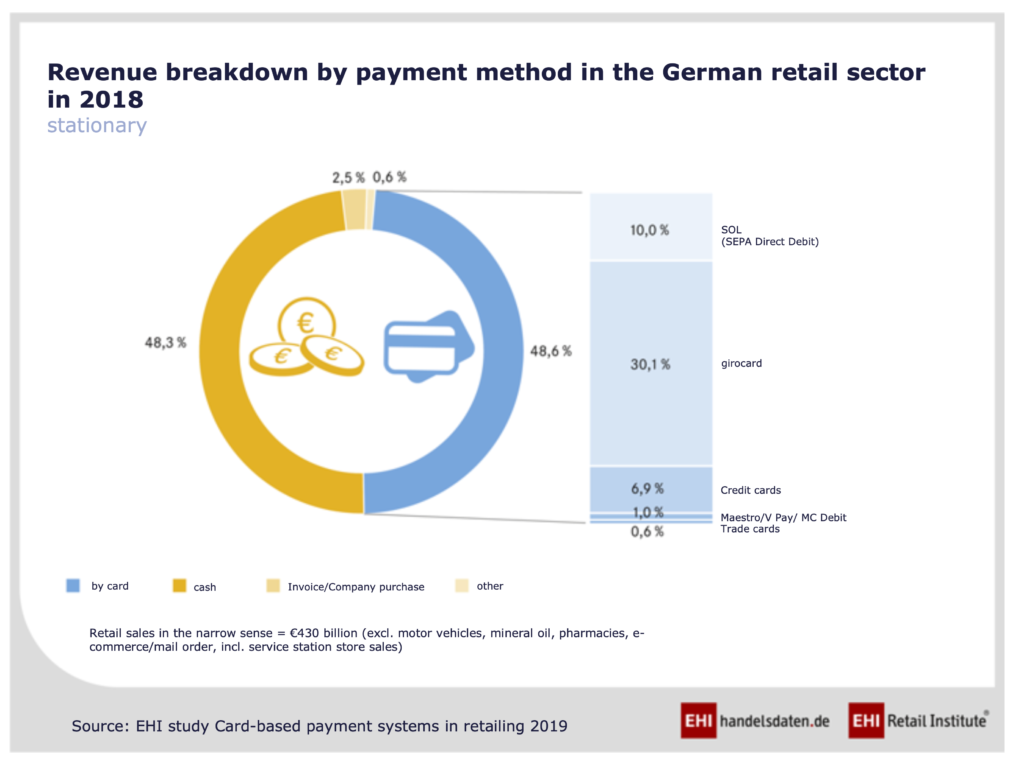

The advance of contactless payment is likely to continue, especially as more and more banks are supporting systems such as Apple Pay and new players such as Bluecode are establishing themselves on the market. This is also supported by the declining share of cash payments in sales, which fell below card sales for the first time in 2018 at 48.3 percent.

In light of the trend, merchants should examine how payments can strategically support the core business. The following aspects are critical:

For several years now, more and more German retailers have been offering the Chinese payment service Alipay at the checkout, including the drugstore chain “dm” since summer 2019. Drugstore goods made in Germany are popular in China. The payment option is aimed on the one hand at tourists, and on the other at Chinese living in Germany who shop for addressees in the People’s Republic.

Before the Corona crisis, Alipay expected a good 160 million international trips from China in 2020. With the retrofitting of payment methods that appeal to new target groups, stationary retailers are standing up to the web stores. In addition to international services, including Alipay or its competitor WeChat Pay , these include innovative processes such as the data-saving Bluecode or cash payments for online purchases at the store checkout.

According to the market research firm Nielsen, the number of store visits in Germany fell from 232 to 193 between 2013 and 2018. The lower the frequency of visits, the more important it becomes to offer customers goods or services that interest them on that very day with every purchase. As the share of electronic payments increases, so does the amount of customer data that can be analyzed to formulate such offers relevant to that day. Tech company Apple, for example, in December 2019 refunded shoppers who paid with the company’s own credit card six percent of the price of goods instead of the usual three percent. Amazon and the Payback bonus system also analyze the virtual receipt in order to encourage customers to make further purchases with offers tailored to content and time.

According to the industry newsletter Finanzszene, Germany’s most profitable bank in 2017 was the finance subsidiary of the VW Group. So if a carmaker is raking in hefty profits with financial services, retail companies should also consider whether setting up a finance division might not be more lucrative than depending on external service providers who are primarily pursuing their own self-interest.

The recast of the EU Payment Services Directive (PSD) facilitates market entry for new players and enables real companies to offer financial services that support their core business. The advantage of this approach lies in the strong alignment of such services with the real economy business model.

While pioneers like the Otto Group failed with Yapital, the chances of success are much better today due to the greater acceptance of mobile payment. The Payback Pay system, for example, which like Yapital operates with QR codes, has established itself on the market.

For years, mobile payment specialists in retail had their hands full with the implementation of regulatory and operational requirements. Now there is more time to drive innovation at the checkout.

Within the Consileon-Group, aye4fin advises DAX-listed companies and start-ups on the topics of electronic payments, e-commerce platforms and data analysis. With profound experience from projects at domestic and international market leaders, the colleagues help design, operate and optimize the relevant systems.

The topic of sustainability has been highly topical at the latest since the Paris Climate Agreement of 2015. The deterioration of the ecological framework conditions was identified as an additional risk for the global economy and the financial industry was explicitly made responsible.

Since then, the EU institutions have been working intensively on the topic of “sustainable finance” and have launched several initiatives in parallel, through which the financing of sustainable projects or companies is to be increased. This has given the financial industry an unasked-for role in European climate policy. At the same time, the sensitivity of society and institutional investors to sustainability issues is increasing, so that customer interest is also changing.

The share of sustainable investment products is still in the single-digit percentage range, but this could change significantly due to the current popularity of the topic. Investors are now increasingly looking for “sustainable” investment products, while companies have started to finance their projects with instruments such as “green bonds”. Asset managers are increasingly embracing the trend and launching corresponding products. However, in order to set up this process optimally, there is a lack of definitions for a uniform understanding of sustainability as well as regulatory framework conditions.

Together, we discussed the following topics in particular with various market participants:

How the above developments are assessed and implemented on the part of financial service providers in the various parts of the value chain was the subject of our World Café. The documentation of the event is now available and should give you an impression of the contents and contributions to the discussion.

Read more in our Broschüre zum World Café (*only available in German).

For further information please do not hesitate to contact us: https://www.consileon.de/branchen/banking/

In the face of the world financial crisis, intensifying social conflicts and the threat of global ecocide, no financial or real company wants to be accused of having an unsustainable business model. Meanwhile, target groups are learning to distinguish serious sustainability efforts from green-colored business as usual.

Above all, the capital markets would have the power to promote sustainable investments, and even to curb climate change. However, not all players are immune to mere greenwashing. The trend toward green financial products is nevertheless (or precisely because of this) unbroken. While $168.5 billion worth of green bonds were issued worldwide in 2018, the volume in 2019 was 263 billion. For 2020, up to 375 billion are expected.

Institutions and institutes in the financial system are also pursuing green finance initiatives. For example, both BaFin and the Bundesbank are among the founders of the “Network for Greening the Financial System,” which analyzes the consequences of climate change for the financial sector and directs capital flows toward low-carbon economic growth. An increasing number of green banks invest according to ecological and ethical criteria.

But what does this market trend contribute to environmental protection? How trustworthy are such financial products? As long as the use of attributes such as sustainable or green is at the discretion of the provider, investors should exercise caution. Anyone who wants to be sure of the environmental sustainability of an investment should not rely solely on a green rating.

A major problem in choosing a green financial product is the lack of a recognized valuation benchmark that could be applied to all asset classes. With its proposal to introduce a European green bond standard, the EU Commission aims to improve the effectiveness, transparency, comparability and credibility of the green bond market and encourage its players to issue or invest in such securities.

The Brussels European & Global Economic Laboratory (Bruegel), a think tank supported by European states, banks and real companies, advises the Commission that the comprehensive taxonomy it is striving for must be flexible enough to do justice to the complexity and dynamics of the market. The target groups of the standard are therefore called upon to negotiate with each other how binding the regulations on green financial products can and must be, so that they neither set too high hurdles nor offer loopholes. It must also be decided which institutions should be responsible for formulating the standard, how it is to be implemented technically, and what private investors can contribute.

It is not only the lack of a standard that makes it difficult to assess the environmental relevance of business models and investment products. There is also a structural information deficit: hardly any companies publish enough information on sustainability criteria such as resource consumption, pollutant emissions or supply chain to derive comparative key figures. This is why potential investors usually rely on analysts to assess the environmental performance of a company or financial product.

American financial scientists have studied such analysts’ opinions. Their findings cast doubt on whether market observers are always right. Among other things, the researchers found that the more difficult the prediction, the more analysts tend to be cognitively biased and optimistic when forecasting stock prices. Another study showed that analysts tend to apply double standards to companies’ social actions: Improvements are more likely to be registered than failures.

In addition, there are universal cognitive mechanisms that make it difficult for humans to judge objectively, including the anchor effect: When making estimates and decisions, we unconsciously orient ourselves to so-called anchors – associated memory contents or information from the context. These have an effect even if they are factually irrelevant or objectively wrong. For example, a solidified green image can cloud analysts’ judgment regardless of a company’s actual eco-balance. A similar thinking error is the availability heuristic: in the absence of exact data, we assess the frequency or probability of an issue or event according to the presence of relevant information in memory, the mass media, or some other readily available source. For example, a current green showcase may cause a corporate analyst to disregard last year’s environmental scandal.

Interim conclusion: The rating of green financial products is subject to cognitive bias and intransparency. Before such products are launched on the market, their issuers usually submit them to an external service provider, such as a rating agency, for review. However, it is difficult for potential investors to understand which criteria are decisive in this process.

Even if an official world standard for assessing sustainable investments were introduced and proved reliable, hardly any agency would publish the observations and calculations on which the grade is based in individual cases. And even if this data were available, the decision would still rest with a committee whose members represent vested interests, ergo are biased. But the World Bank is not alone in believing that the green bond market can only grow in the long run if it becomes more transparent. Michael Wilkins, infrastructure finance analyst at S&P, also states: “Green bonds are still uncharted territory. How they evolve depends largely on the credibility of the issuing companies and the standards they set and adhere to.”

The state of the world requires a rethink. Consileon is leading the way. Our experts tap sources of insight, evaluate their information using proven and new methods ranging from data mining to artificial intelligence, and network them both with each other and with current expertise. Real-time opinion analyses show what is currently on the minds of the target groups. Methods and tools from computational linguistics (natural language processing, NLP) can be used, for example, to evaluate speeches at board level or investor meetings. AI applications can be trained to identify discrepancies between a company’s public communications and its actions. Tools developed specifically for analysts help avoid cognitively biased decisions by detecting information that challenges preconceptions or thought patterns.

A classification that realistically categorizes the environmental added value of green financial products is urgently needed. To help our clients seize the opportunities of economic and socio-ecological change, we closely monitor the development of business models and products that reconcile financial gain with environmental protection and participate in many projects to do so. Do you have any questions or would you like to expand your company’s ecological expertise? Then we look forward to hearing from you. More about our services for capital market players at: consileon.com/industries/capital-markets

As a result of technological change, the retail industry is going through turbulent times. Extensive market transparency, new competitors and increased product knowledge are creating an environment in which traditional retail cannot survive. Those who do not act now will not survive the storm.

More sustainable than striving for price leadership is upgrading the respective basic product to Product+. This means that the retailer offers extras and services with which the customer can individually enrich a product as required. This significantly increases relevance for the customer.

We have technical expertise in building and analyzing customer data and years of experience in developing and implementing sales strategies in retail.

We support you in expanding your customer data, analyze your product range and develop your product+ together with you.

Put us to the test!

Consileon shows you how. We help companies to measure and continuously increase the sustainability of structures and processes along their value chain. Our services range from strategic consulting and organizational implementation to technical support through standard or custom software.

Together with you, we define key performance indicators that can be used to track progress toward greater sustainability and provide evidence in both internal and external reporting. We support the introduction of processes and software to manage these indicators, as well as the occasional readjustment of targets and strategy. In addition, we offer solutions that facilitate compliance with legal regulations and technical standards on sustainability.

Consileon’s consulting and software offering is designed to be holistic on the one hand and modular on the other. Companies can thus initially optimize individual factors of their sustainability and later integrate further areas into their solution as required. Our portfolio includes the following services, among others:

Since fiscal 2017, companies with more than 500 employees have been required to address their sustainability in their annual report. In concrete terms, this means disclosing supply chains and the impact of production on workers and the environment. Companies must also vouch for the sustainability of their suppliers.

Your software was developed specifically for the processes in your company. Why shouldn’t what has already proven itself in your German branch work in all branches around the world? A common software for all branches means for you: Scaling effort and saving costs.

We help you implement your software at all of your company’s locations. We pay particular attention to local specifics – after all, the success of an international rollout stands and falls with the acceptance of the software by all future users in your company.

What our customers particularly appreciate about Consileon is the trusting, partnership-based and results-oriented collaboration. Whether it’s a fixed price or billing based on time and effort, our top priority is to make the software rollout a success on time and on budget. To ensure user satisfaction in the long term, we offer long-term support for the software solution beyond distribution, integration and training.

In the banking and healthcare sector, strict government regulations keep watch over IT security. What many banks and insurance companies see as a burden, we turn into an opportunity: We help you translate government regulation into IT that is not only secure, but also profit- and user-oriented. We can do this because we are not only strategic thinkers, but above all IT developers. We don’t think of your IT security from the control requirement, but first and foremost make a good IT product – which integrates strict security measures as a matter of course.

In addition to the theft of intellectual property such as design and production data, stolen personnel and customer data can also become a problem or cause major reputational damage.

As a rule, banks do not open their IT to the outside world for security reasons. That’s why you can’t use an app to operate your account, for example. If banks had better, more secure IT, they could do just that: they would be able to offer new innovative business models such as apps via interfaces to the outside world. Just like fintechs, banks could launch innovative financial products on the market and finally take on the competition from Europe and the USA again.

We take a holistic view of regulation and IT. We always start by considering how we can develop good software from our “IT perspective”. Then, of course, we integrate the regulations into the system.

For the control authorities you need to prove that you apply the regulations? We are only too happy to support you in this: we have the technical expertise for every type of IT test and pride ourselves on our mature cyber security.

With increasing digitization and networking, the number of nodes through which hackers could invade and cause damage is multiplying. With special tools, hackers find simple technical vulnerabilities automatically. Employees themselves are also a major security risk if they respond to phishing mails or fail to observe important security standards.

In addition to the theft of intellectual property such as design and production data, stolen personnel and customer data can also become a problem or cause major reputational damage.

It also becomes expensive if an attack stops production. Last but not least, manipulated machines can even endanger the safety of employees.

The attackers get into the system through phishing mails or ransomware.

Ransomware is malware that directly attacks the system and prevents the computer owner from accessing data, using it, or the entire computer system. (Ransom, English for “ransom”). The hackers take advantage of the employee’s ignorance and trick him, e.g. with good texts, into clicking on a message, opening something and thus letting the virus “into the house”. In “phishing”, the hacker tries to obtain the user’s personal data using fake email addresses or websites.

Some companies have already fallen victim to a hacker without realizing it. The manipulations only come to light much later, through complaints from customers or suppliers. If an infiltrated system is not misused to distribute spam or malware, it can take an average of 300 days before the intrusion is discovered!

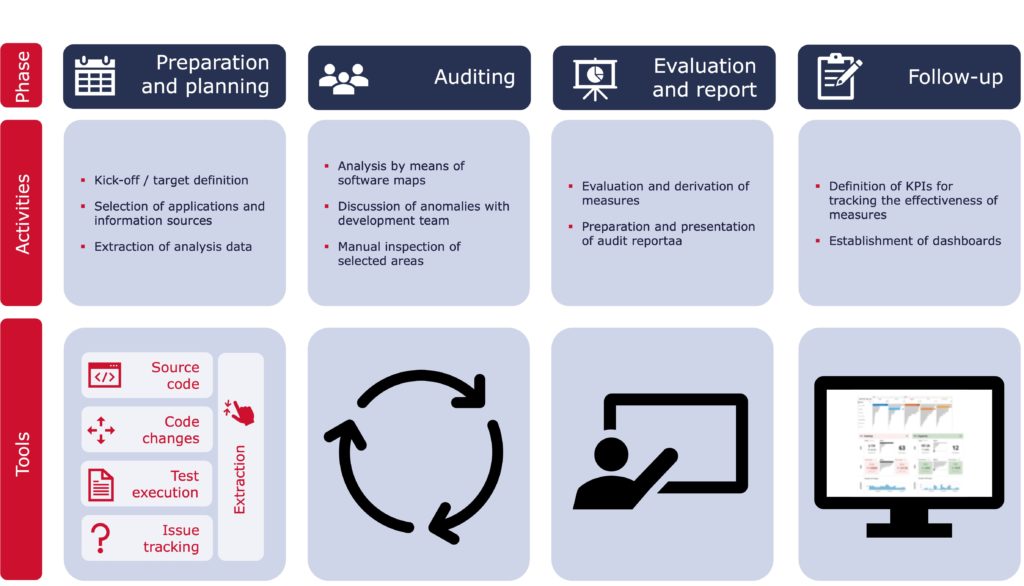

We conduct our audits according to a four-phase model:

Only after intensive planning and preparation with target definition do we perform the actual software audit, specifically adapted to the requirements of the respective project. In the follow-up, we deliver a detailed report that is compared with the original requirements and defines measures. We develop KPIs and set up dashboards for monitoring in order to be able to generate a sustainable and lasting overview of the quality of the IT product.

Here’s how our audits work in detail:

In addition to its administrative duties, the federal government is driving change in society.

How will mobility be organized in the future? What will happen to the living space in cities? Challenges that can be solved more easily through cooperation with industry.

Since we are active in almost all industries, we can establish points of contact with other industries and advise them. Congestion prevention or parking space management, for example, lend themselves to collaboration with the automotive industry. While our colleagues from the automotive industry bring the technical view and the user data, we add the structural view. Together, major challenges can be solved smartly with IT.

But cities are also increasingly interested in networking their infrastructure. Parking search systems almost completely eliminate parking search traffic, which today accounts for 20 to 30 percent of urban traffic. Intelligent systems thus spare the nerves of drivers, residents and ultimately the environment.

In numerous projects, we have been able to build the smart city of the future together with local authorities. Get in touch with us. We will advise you on your individual problem.