Sustainable investments are becoming increasingly important. In addition to growing customer interest, regulation is also formulating specific requirements for sustainable investment practices. This article sheds light on the challenges of customer-centred ESG investment advice and shows how a customer experience with added value can be created.

Since August 2022, MiFID II has required sustainability preferences to be included in investment advice. Although more than half of all retail investors stated in various surveys that they wanted to take sustainability preferences into account, [1] only 15 to 20 per cent actually selected such an ESG option in their investment advice. [2] The reasons for this are the fear of lower returns with sustainable investment products, the “unworldly” regulatory terms [3] and a limited product range in some cases. Consileon’s project experience to date shows that many institutions are well positioned when it comes to implementing regulatory requirements, but have difficulties in developing regulatory compliance into a customer-oriented process. At an aggregated level, BaFin’s covert tests in July 2023 showed that 87 per cent of investment consultations included a query about sustainability preferences. [4] At the same time, however, BaFin feels compelled to investigate the current implementation at a number of German banks in detail. The banks surveyed are to provide quantitative information on the distribution of sustainable investment products to date and provide insights into the organisation of the advisory process.

Based on the BaFin checklist and on existing market analyses and experience reports, Consileon has developed a concept for the customer-centric design of ESG investment advice, which focuses on the following fields of action:

- Demand and target group analysis

- Product range and design

- Process framework and communication

- Consultancy process

1. Demand and target group analysis: How can the various sustainability needs of your own customers be understood and structured?

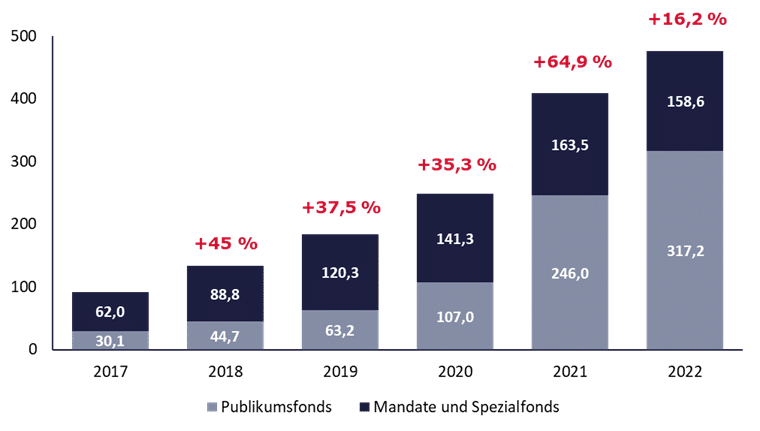

Many financial institutions have already discovered sustainable investments as a growth area for themselves. For example, the Forum Nachhaltige Geldanlagen (Forum for Sustainable Investments) estimates a volume of EUR 475.8 billion for sustainable mutual funds, mandates and special funds in Germany in 2022, which corresponds to growth of 16 per cent compared to the previous year. [5]

Although younger generations tend to have a higher affinity for sustainability [6], sustainability preferences are a highly individualised issue. While some customers only want to exclude particularly harmful or controversial economic sectors (e.g. fossil fuels or weapons) from their investment, for others even the “greenest” of all existing products do not fulfil their own sustainability requirements. Due to the wide range of sustainability definitions and terminology, there is a great deal of uncertainty among customers as to which product actually fulfils their own sustainability preferences. If a product cannot achieve the promised sustainability effect or the sustainability effect expected by consumers, the provider may be accused of greenwashing, along with the resulting reputational risks.

The customer’s sustainability needs should not be clustered during the consultation, but ideally in advance. In a personal dialogue, the sustainability-related analysis of the current state of the portfolio can be a potential starting point, in which an initial approach to the regulatory vocabulary is also possible. A joint comparison of the sustainability-related actual and target status can then form the basis for a targeted advisory process. In addition, interactive online investment tools (“Get to know your suitable ESG investment in just 5 minutes”) can provide customers with a low-threshold introduction to the topic and the available product framework. A transparent presentation of which sustainability needs can actually be covered by an ESG product also increases trust and customer loyalty.

2. Product range and design: How can customer needs and product range be harmonised and further developed?

Even an advisory process that is carefully tailored to customer needs can fail due to the reality of the existing product range. In some cases, the limits of the offering are also set by the constantly evolving regulatory requirements and at the same time require a permanent review of the categorisation of the company’s own products. Impact and thematic investments outside of the climate and environmental dimension are a weak point in the product portfolio of many providers, particularly in the retail sector.

In order to cater to different sustainability preferences, the product range should ideally include a selection that allows for variations in terms of both the level of ambition (light to dark green) and the thematic focus (from climate protection to human rights). Especially for investment products with a major sustainability promise, an appropriate presentation of the sustainability impact is required in order to make the impact of one’s own investment comprehensible for customers. In addition to quantitative benchmarks (“Your investments have saved xyz tonnes of CO2”), case studies on supported projects can create a stronger emotional connection.

3. Process framework and communication: How can customised ESG communication succeed and be linked to the advisory process?

The customised design of investment advice only unfolds its full effect with appropriate process integration, for example by previously clustering sustainability preferences as well as querying and increasing prior sustainability-related knowledge. At the same time, the experience gained from the counselling sessions provides valuable insights into the sustainability-related needs of customers. Frequently asked questions on specific areas of sustainable investment can serve as an impetus for expanding and adapting the information provided to date. Discrepancies between the ESG investments in demand and the existing product range provide a clear orientation for further development in this regard. In this context, the end of the consultation should be seen as the starting signal for the ESG customer journey, as the individual sustainability preferences allow a specific assessment of the customer that goes beyond economic parameters. The stored sustainability preferences can be used for customised product recommendations that not only meet individual risk and return requirements, but also take into account issues of personal importance. This enables a more personalised approach, for which, for example, the achievement of previously defined, sustainable impact targets can serve as an impetus for regular contact.

4. Counselling process: How must the process framework be designed to ensure structured counselling in the interests of the customer?

The complexity of querying sustainability preferences is due to the dependence on a large number of supervisory regulations such as the EU Taxonomy or the EU Sustainable Finance Disclosure Regulation (SFDR) and the technical terms derived from them such as “Principle Adverse Impacts” (PAI). From the client’s perspective, these can hardly be linked to the respective understanding of sustainability; investment advice must therefore act as a translator between regulatory and client language.

The regulation also provides for a detailed process corset for the preference enquiry. In order to counteract an overloading of the advisory discussion, customer advisors must be provided with clear process guidelines that enable a structured discussion. In this context, the current limits of their own product range must also be openly stated in order to avoid dead ends in the consultation (“Unfortunately, we cannot offer a product for your preference”).

The content to be queried must be formulated in easily understandable sub-questions and customer-orientated language. A balance must be struck between preparing the content as thoroughly as possible and simplifying or summarising information. For example, explanations of basic sustainability terms can be shortened for customers with a high level of sustainability expertise. For customers with little experience of sustainability, detailed explanations of terms at the beginning of the conversation can increase the feeling of security during the consultation. Accordingly, it is more important to explain the sustainability impact of dark green products to customers using suitable (quantitative) indicators than is the case with light green products. In contrast to traditional economic parameters such as return and risk, sustainability aspects also offer the opportunity for a more personalised discussion of customers’ preferences and needs during the advisory process. Customers can be addressed on an emotional level through visualisations or vivid project examples. A transparent and personalised customer approach as a clear counterpoint to the rational regulatory process requirements enables banks to set themselves apart from their competitors and use ESG investment advice as an opportunity to deepen the customer relationship.

Conclusion

Even though the requirements to enquire about sustainability preferences initially entail a high level of integration effort, the mere fulfilment of the obligation offers the ideal starting point to draw customers’ attention to sustainable investments and to benefit as a bank from the dynamic market development. A customer-centred design of the processes (freestyle) can not only increase customer benefit and strengthen customer loyalty, but also provide valuable impetus for the further development of the bank’s own processes and product range. A customer-centred ESG advisory process thus serves as proof of the company’s own ESG expertise and creates trust for cooperation in other business areas with a sustainability focus, for example in the financing of real estate or its (energy-related) refurbishment. The sustainable reorganisation of the financial market is only a matter of time. The best possible customer-oriented implementation of regulatory requirements is therefore of central importance for securing and expanding our own competitiveness.

Consileon is characterised by extensive experience in the customer-oriented design of processes. We have already developed strategies for the integration of ESG aspects in investment advice for various companies that go beyond the fulfilment of regulatory obligations to create a customer experience with added value. If you would also like to take a closer look at the customer-centred design of ESG investment advice and use sustainable investment as a growth opportunity, the experts at Consileon look forward to talking to you.