Several years behind European neighbors such as Denmark, Sweden and the Netherlands, mobile payments have now also arrived in Germany. Driven by the large, mostly American card companies and tech groups, retailers, banks and network operators have upgraded the payment infrastructure and developed processes that are gaining acceptance among the public. At the beginning of 2018, only one in five people made contactless payments by bank card, credit card, smartphone or smartwatch; according to a Postbank study, this figure rose to one third within a year.

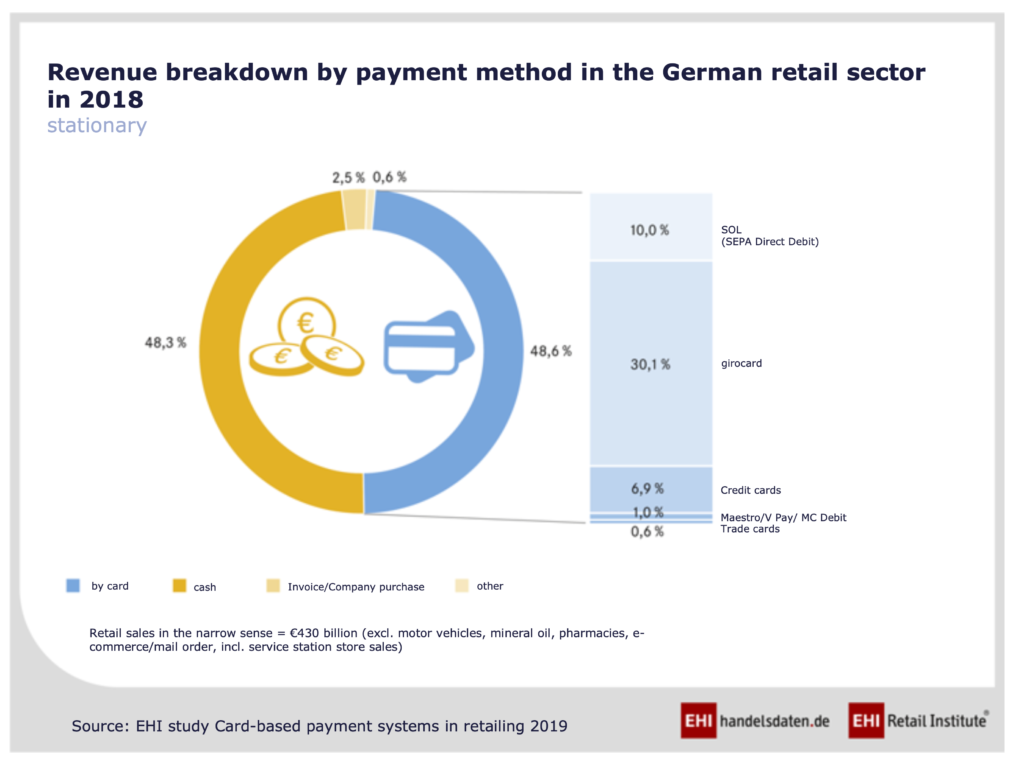

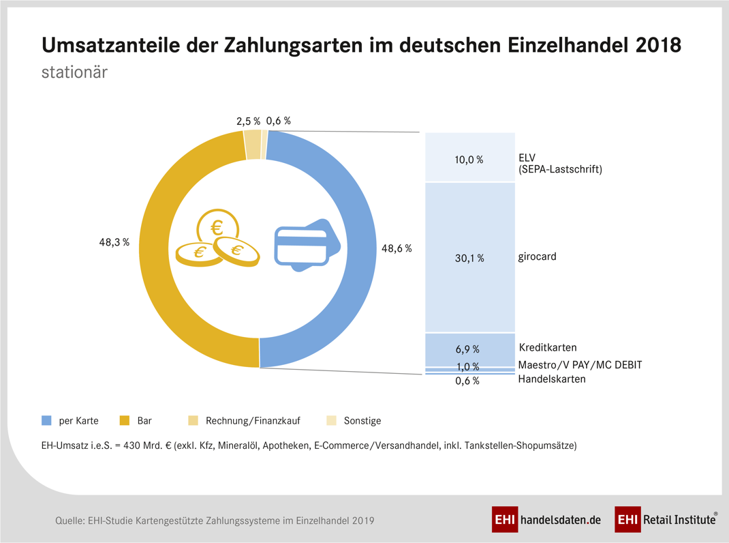

The advance of contactless payment is likely to continue, especially as more and more banks are supporting systems such as Apple Pay and new players such as Bluecode are establishing themselves on the market. This is also supported by the declining share of cash payments in sales, which fell below card sales for the first time in 2018 at 48.3 percent.

In light of the trend, merchants should examine how payments can strategically support the core business. The following aspects are critical:

- The availability of the payment method requested by the customer

- Imminent relevance of the offer

- Own payment services

Payment method availability

For several years now, more and more German retailers have been offering the Chinese payment service Alipay at the checkout, including the drugstore chain “dm” since summer 2019. Drugstore goods made in Germany are popular in China. The payment option is aimed on the one hand at tourists, and on the other at Chinese living in Germany who shop for addressees in the People’s Republic.

Before the Corona crisis, Alipay expected a good 160 million international trips from China in 2020. With the retrofitting of payment methods that appeal to new target groups, stationary retailers are standing up to the web stores. In addition to international services, including Alipay or its competitor WeChat Pay , these include innovative processes such as the data-saving Bluecode or cash payments for online purchases at the store checkout.

Imminent relevance

According to the market research firm Nielsen, the number of store visits in Germany fell from 232 to 193 between 2013 and 2018. The lower the frequency of visits, the more important it becomes to offer customers goods or services that interest them on that very day with every purchase. As the share of electronic payments increases, so does the amount of customer data that can be analyzed to formulate such offers relevant to that day. Tech company Apple, for example, in December 2019 refunded shoppers who paid with the company’s own credit card six percent of the price of goods instead of the usual three percent. Amazon and the Payback bonus system also analyze the virtual receipt in order to encourage customers to make further purchases with offers tailored to content and time.

Own payment services

According to the industry newsletter Finanzszene, Germany’s most profitable bank in 2017 was the finance subsidiary of the VW Group. So if a carmaker is raking in hefty profits with financial services, retail companies should also consider whether setting up a finance division might not be more lucrative than depending on external service providers who are primarily pursuing their own self-interest.

The recast of the EU Payment Services Directive (PSD) facilitates market entry for new players and enables real companies to offer financial services that support their core business. The advantage of this approach lies in the strong alignment of such services with the real economy business model.

While pioneers like the Otto Group failed with Yapital, the chances of success are much better today due to the greater acceptance of mobile payment. The Payback Pay system, for example, which like Yapital operates with QR codes, has established itself on the market.

For years, mobile payment specialists in retail had their hands full with the implementation of regulatory and operational requirements. Now there is more time to drive innovation at the checkout.

Your payment expert at Consileon: aye4fin

Within the Consileon-Group, aye4fin advises DAX-listed companies and start-ups on the topics of electronic payments, e-commerce platforms and data analysis. With profound experience from projects at domestic and international market leaders, the colleagues help design, operate and optimize the relevant systems.