Overview of the current situation and demand in Germany

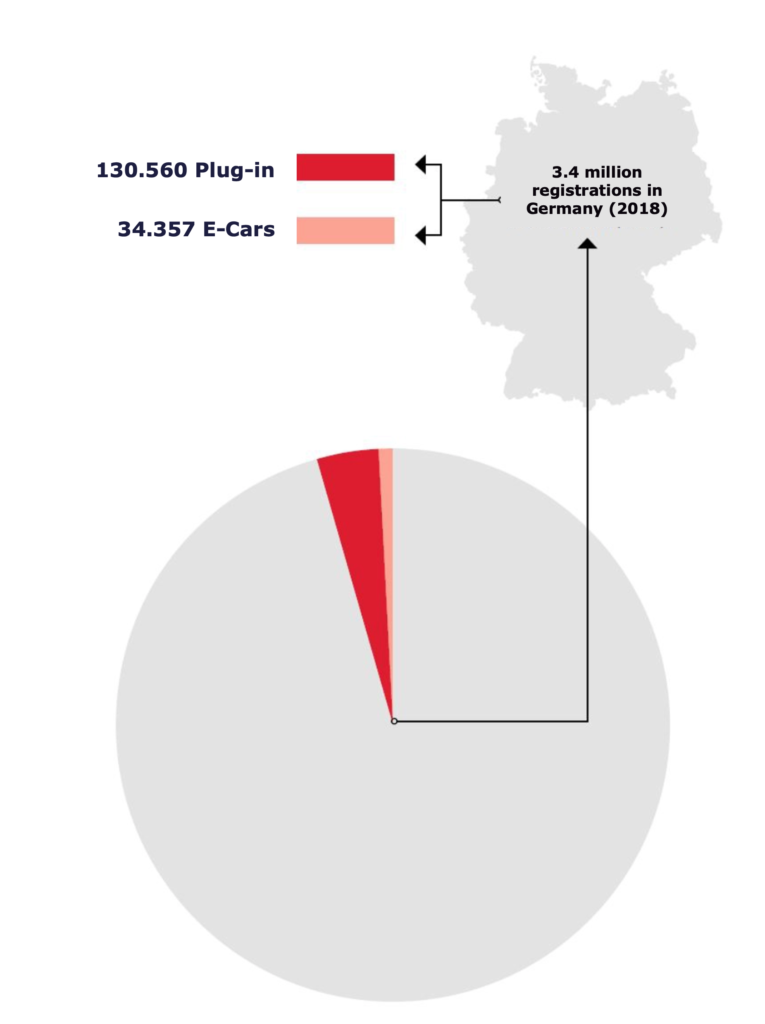

In Germany, around 130,560 plug-in hybrids and 34,357 pure electric vehicles were sold in 2018. With up to 3.4 million registrations annually in total, these two market segments together account for a market share of just under five percent. In the previous year, only 25,056 pure electric cars were registered. This indicates a positive trend.

The moderate market share contrasts with the expectations of the target group. According to a panel study by the British opinion research institute YouGov, 55% of drivers see the e-car as the means of transport of the future. Nevertheless, in addition to the purchase price and range, respondents cited the distance to the nearest charging station as a key hurdle before making a purchase.

A project designed to make everyday life easier for e-mobilists comes from Apple. The American tech company has started to include the charging stations of the operator Chargepoint in its digital street maps. However, this function is not yet available in Germany.

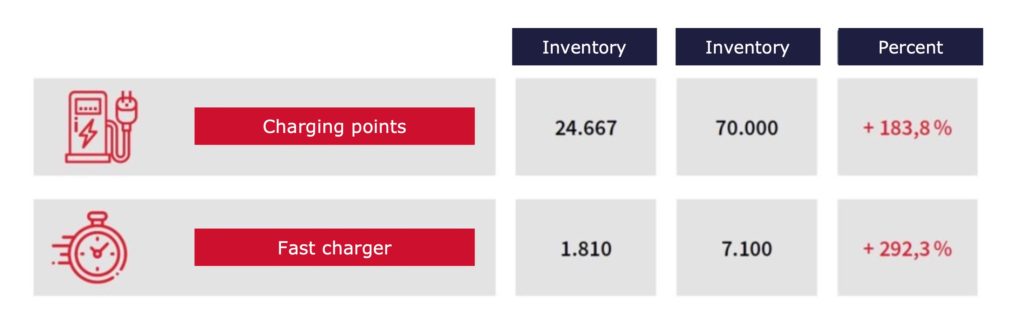

The European Alternative Fuels Observatory (EAFO), which is funded by the European Commission, currently counts 16,055 electric charging stations in Germany with a total of 48,367 connections. For 2020, the German government’s National Platform for Electromobility (NPE) anticipates a need for 70,000 public charging points, including 7,100 fast-charging stations.

In 2018, the number of charging points in Germany increased by more than 340%. In absolute terms, Germany is the European leader with 48,367 charging points. However, if you compare this figure with the country’s surface area and population, it becomes clear that others are leading the way in terms of electromobility. While Germany’s e-mobilists found a charging station every 111 kilometers on average in 2016, in the Netherlands it was only seven kilometers away.

In order to make improvements, the German Federal Ministry of Transport and Digital Infrastructure issued the first 26 funding notices for charging columns totaling a good 550,000 euros on June 9, 2017. The program is intended to establish a nationwide charging infrastructure with 15,000 charging stations. To this end, the ministry is providing a total of 300 million euros by the end of 2020, two-thirds of which for fast chargers.

The head of the electric mobility division at Mercedes-Benz, Jürgen Schenk, however, urges calmness. Thanks to advances in battery development, there will soon be an oversupply of charging stations. Ranges of 500 kilometers and more are on the horizon. At that point, fast chargers along the highway will be sufficient.

Fast charging is currently only possible at 1,810 charging points in Germany, of which more than twenty percent are Tesla’s so-called Superchargers, which are reserved for drivers of the brand. The state and private companies are trying to drive forward the expansion of the infrastructure needed for electromobility with projects that are attracting a lot of media attention. One example is the so-called fast-charging axis along the A 9 between Munich and Leipzig. Siemens, Eon and BMW set up eight fast-charging stations there in mid-2014 at intervals of no more than ninety kilometers. Tesla is running its own major project in Europe. The carmaker supplies its customers with electricity free of charge at a good 700 charging stations with almost 5,000 connections. Daimler, BMW, Volkswagen and Ford have joined forces in a similar project. Together, they want to install several thousand fast chargers along Europe’s main traffic routes. The first 400 are planned for 2019. The German Federal Ministry of Transport wants to install another 400, also by the end of the year, although only one hundred of these had been completed by the end of July. The planning basis is provided, among other things, by the SLAM (Fast Charging Network for Axes and Metropolises) research project presented at the Hanover Fair in 2017.

Charging systems on the market

Four systems for charging traction batteries dominate the European market: Schuko, Type 2, CCS and Chademo. The most popular is the alternating current from the household socket via the Schuko plug. With this, an empty battery can be fully charged in eight to twelve hours at a power of 3.6 kilowatts. A positive side effect of the long duration is that the battery is protected and lasts longer overall. In addition, the charging loss is lower. The EU standard is the Type 2 connector. It normally charges with alternating current and is compatible with its successor CCS (Combined Charging System), which also works with direct current. The Japanese competitor product Chademo works in a similar way to CCS. Across systems, a distinction is made between normal (AC) connections and fast chargers. The latter accept direct current and fill the battery to 80% in half an hour. CCS and Chademo are best suited for this purpose. But even with the older Type 2, a charge level of 80% can be achieved in under an hour with direct current. Because of its compatibility with the Type 2 plug, the German car companies rely on CCS. Chademo is mainly installed by Asian brands and is therefore widely used in Asia and America. Tesla is also taking a special approach to fast charging with direct current: In its European charging station network, the U.S. manufacturer uses a proprietary charging plug based on Type 2.

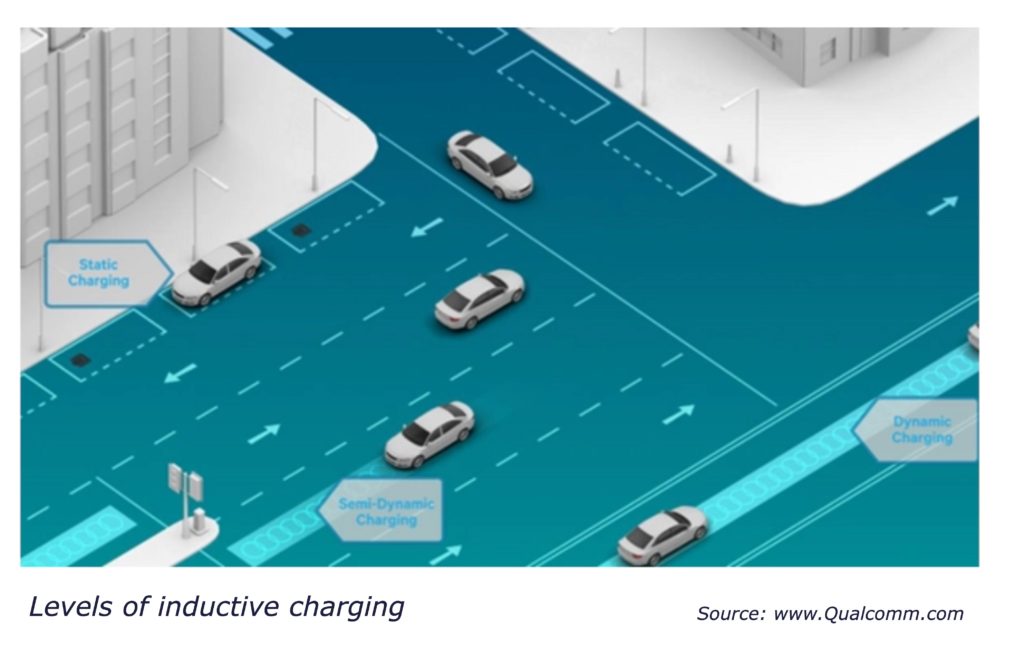

Beyond the plug-in competition, a technology is on the horizon that could displace all of these systems and erase the word gas station from our vocabulary: inductive charging. Similar to the batteries in electric toothbrushes or smartphones, traction batteries can pick up electricity without contact via coils in cars as well as in private or public parking areas or even in the roadway. In the car, the coil is mounted under the front axle; in the ground, it lies under a plate measuring just under one square meter. The distance between the two coils is ten to fourteen centimeters. BMW is already using the technology in special vehicles in Formula E races. The charging plates can be recessed into the ground and only identified by colored markings. The vehicle takes a short charge there while parked. This so-called snack charging puts less strain on the battery than continuous or full charging.

Alongside BMW and Audi, Nissan is one of the suppliers most advanced in wireless charging. The Japanese are currently testing a system in which semi-autonomous e-cars exchange information, automatically navigate to the charging point and clear it for other vehicles once the power snack has been taken.

But this is still a long way from exhausting the technology. The next step is inductive power consumption at low speeds over short distances, known as semi-dynamic charging. Examples include cab stands, traffic lights and railroad crossings. In Braunschweig and Berlin, some e-buses are already being charged with electricity at bus stops on a trial basis. The final stage of development would be dynamic charging while the vehicle is in motion. An EU project called Fabric is underway on a test route in France. The idea is to install a series of charging plates in one lane of the highway that inductively supply electricity to the traction batteries of electric cars at speeds of 120 km/h.

Electric charging stations from a commercial perspective

Setting up a Type 2 charging station with two charging points costs around 10,000 euros today, while a fast charger costs more than three times that. Thanks to rising unit sales, the price of a simple charging station is likely to drop by a quarter to 7,500 euros over the next three years. Nevertheless, it will not be possible to earn money in the medium term from the construction and operation of charging stations alone.

To the annoyance of customers, the payment modes at Germany’s electric charging stations differ depending on the operator. They often require membership and each issue their own cards. With around 1,700 charging points, RWE currently maintains the densest network. Customers pay a basic monthly fee of €4.95, which also allows them to fill up with electricity at partner companies. This option is known as e-roaming. The Group charges a further 30 cents per kilowatt hour charged.

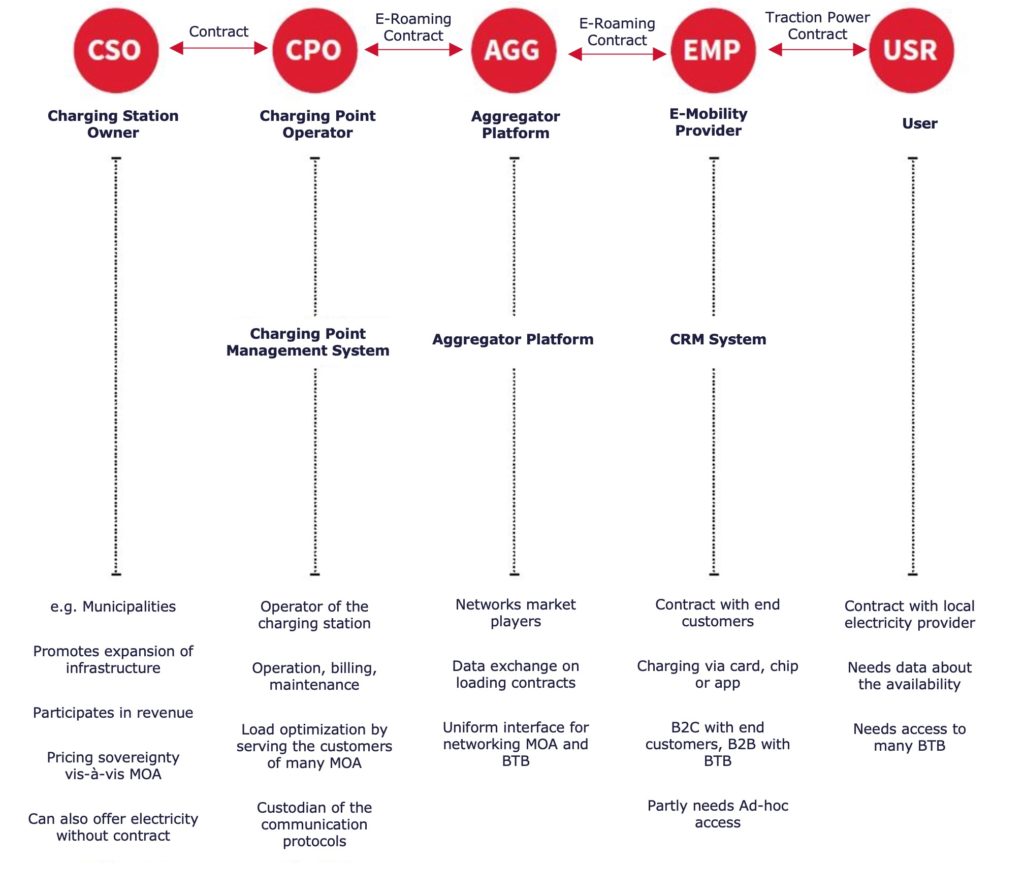

Plugsurfing, a company founded in 2012, is tackling the proliferation of payment methods. It markets an app that is designed to enable payment at all charging points in Europe, regardless of the operator or platform. The service works similarly to PayPal. It is free of charge for the customer; the charges are borne by the owner of the charging point. In the Netherlands, payment with Plugsurfing is now possible everywhere. In Germany, at least 70% of the charging infrastructure is compatible with it. The complexity of the overall system results from the large number of market participants, their roles, and the differences in their positioning. This is illustrated in the following graphic:

Despite poor profit prospects, the oil company Shell is also planning to start building e-charging stations in 2019. For the time being, these are to supplement the fuel available at filling stations in the UK and the Netherlands. Because of the generally longer waiting time for electric refueling, the group hopes for more sales in the catering industry.

But it will hardly be possible to compensate for the declining business with fossil fuels by serving more coffee alone. Oil companies and service station operators will have to rethink their approach and open up new areas of business. This issue will become a matter of existential importance as soon as vehicles of autonomy level 5 approach market maturity. What will the gas station attendant sell the customer when the car rolls up to the fast charger without a driver? The entire automotive industry, including suppliers, will be faced with another major change when wireless charging systems become standard. At the latest, a mass-market concept for dynamic, inductive charging will put an end to the discussion about the capacity and range of traction batteries. Beyond its captivating convenience, such a system will enable massive savings on the e-car’s biggest cost item: the battery. This in turn will give electromobility a strong impetus for growth.

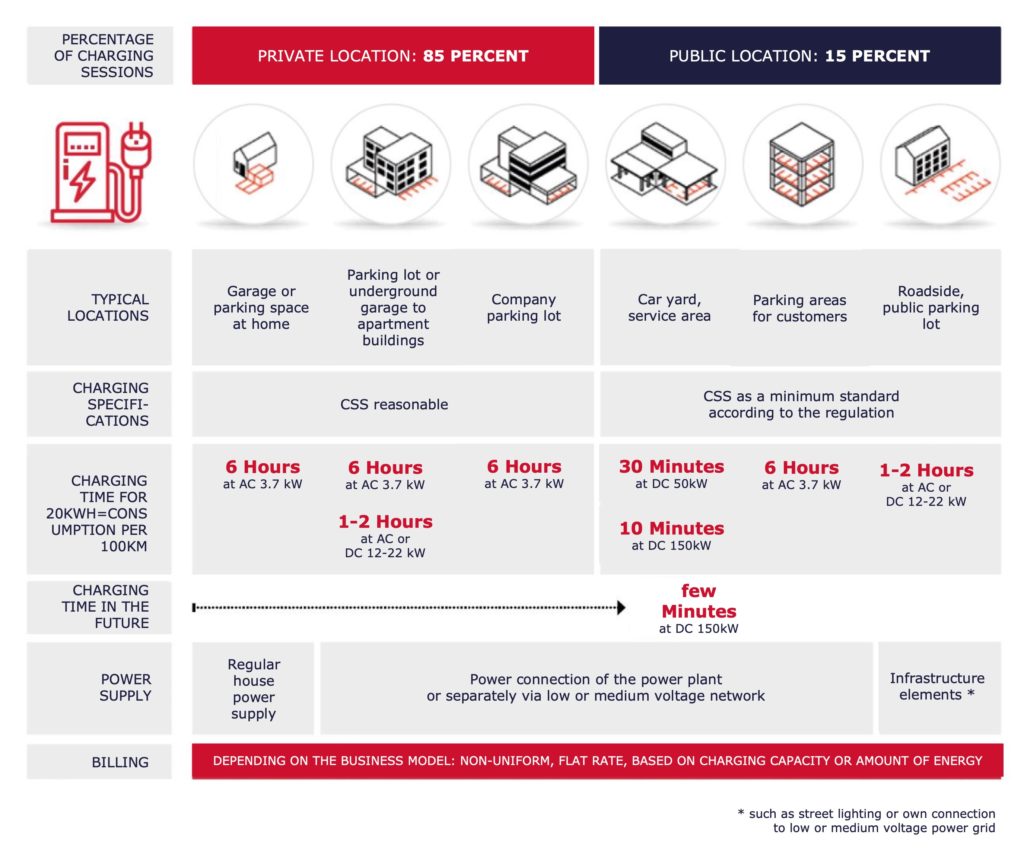

Charging infrastructure at a glance

In Germany, the market environment for charging station services is as follows:

The Federal Network Agency has created a register with an active map of the infrastructure in Germany for the charging stations registered to date and certified by TÜV (blue= charging stations, red= fast chargers).

The German Federal Network Agency has created a register for the charging stations that have been registered and certified by TÜV to date, with more active infrastructure (blue= charging stations, red= fast chargers).

Reservations

In 2018, electric vehicles accounted for just one percent of new registrations. In Germany, two-thirds of energy is still generated from coal and gas. That is why the carbon dioxide value of an e-car, measured in grams per kilometer, is still higher than that of a diesel car. To generate the electricity for the planned forty million e-vehicles in a climate-neutral way, an additional 35,000 wind turbines would be needed on land. Another, often neglected point is the 35 billion euros in state revenue from fuel taxes that would be lost through a system change.