Hey Siri, what is the weather going to be tomorrow? Alexa, take me to the nearest sushi restaurant! Many owners of smart cell phones, speakers or televisions appreciate the option of having voice assistants search for information or make purchases over the Internet. While voice control was long regarded by German companies as a gimmick, a short-lived fad whose supposedly narrow added value was not worth the development and integration effort, it is now conquering one type of application and device after another.

The voice assistant also performs well in the car, dialing a phone number or playing the driver’s favorite song when called. The driver keeps his eyes on the road and his hands on the steering wheel.

Isabelle Hoyer is now advising Consileon’s management on social diversity in the workplace. The consulting firm relies on the expertise of the founder and mother of two in developing a diverse, inclusive workforce and adapting the work environment to diverse lifestyles and needs. In addition, Hoyer will support the Karlsruhe-based company in internal and external networking and stimulate exchange on topics such as women in consulting, everyday work and family, and the innovative power of a diverse workforce.

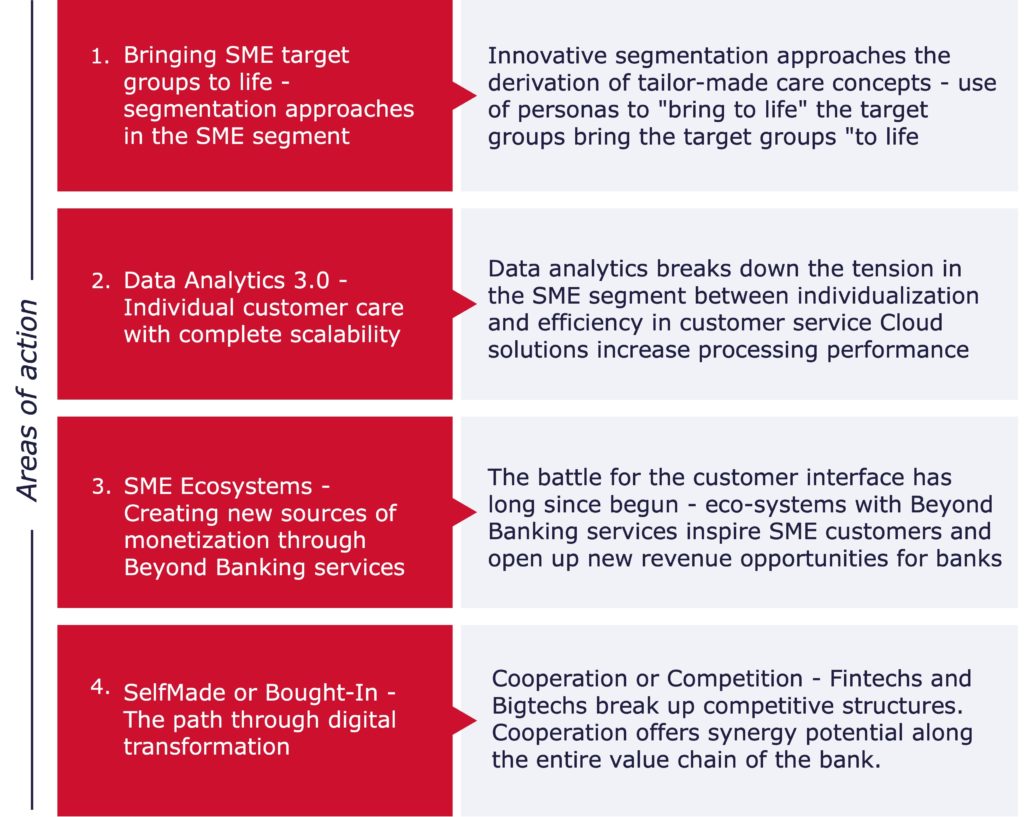

Our study “2025 Future SME Banking – Welcome to the New Normal” helps banks or savings banks in the business customer segment to sustainably secure their existence in an ambitious market environment and to maximize their potential for success. SMEs have formed the strong backbone of the economy in this country for decades. This is one of the reasons why business customers are an attractive segment for financial institutions – from regional to national and international financial institutions – although they are still insufficiently developed. Taking into account the effects of the Corona crisis for SME banks as well as SMEs, we show new, exciting fields of action for a sustainable, modern future.

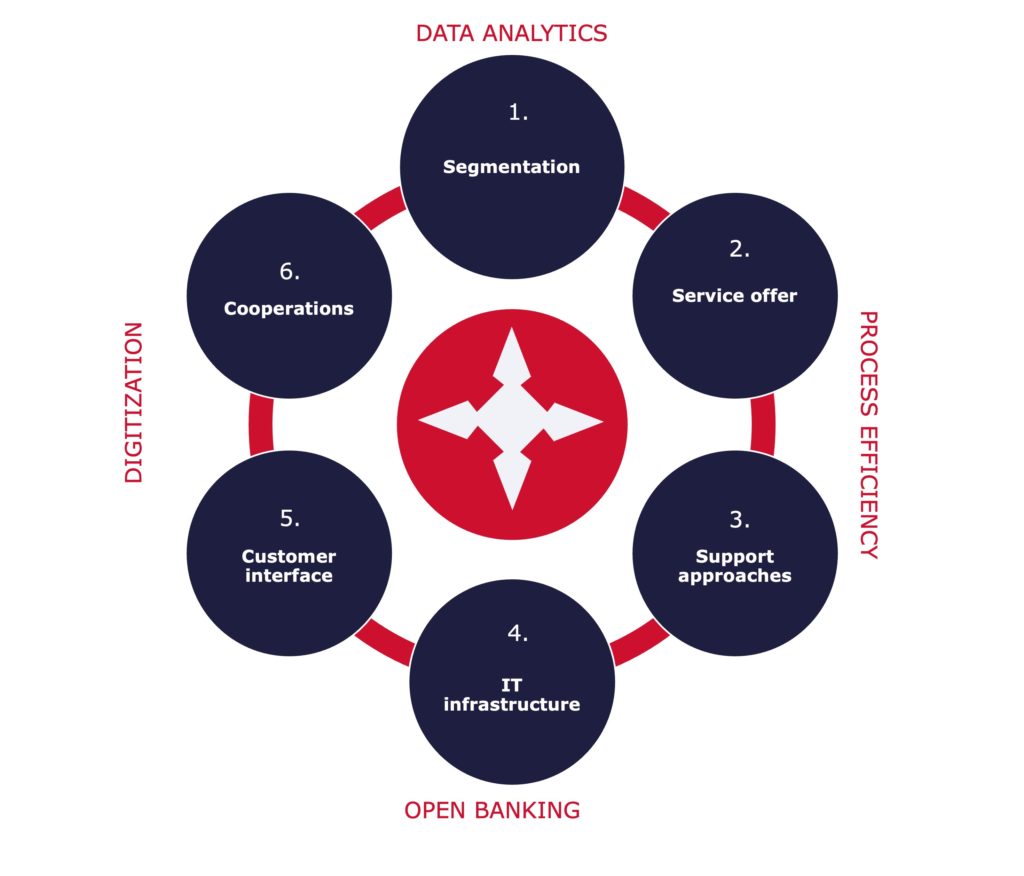

Act. But now! Missing strategies for the orientation of the SME business segment as well as a lack of individuality of the SME customer result in low profit margins. In order to exploit the hidden potential of SME customers, we provide you with the Consileon “SME Banking Transformation Compass”, a toolbox for the future design and exploration of your SME business model.

Our transformation compass helps you to illuminate the entire business model and ensure that the four success factors are successfully implemented on the basis of six fields of action. The influencing factors in the outer circle form the basis. Digitization, data analytics, process efficiency and open banking are central elements in the SME business and are therefore reflected in all six fields of action:

The model also aims to make SME banks more resilient to exogenous crises in the future and increase the organization’s adaptive capacity.

Request your personal copy of the study today. (The study is in German)

The sustainability megatrend in the financial industry is in full swing. The regulations that have already been passed or are in the legislative process are forcing banks and asset managers to deal intensively with this topic. Even if final standards are still being developed, the first steps should already be taken.

Clear integration of the guiding principles for taking sustainability into account in the corporate strategy is essential. The positioning of the financial institutions must be credible and, above all, implementable in order to protect themselves from the trap of “greenwashing“.

Product and sales concepts are based on the fundamental positioning for sustainability. Account, investment and financing products should have a clear focus on sustainability. This added value can be brought to the customer’s attention as an additional impulse in the advisory service.

Consileon established a competence team three years ago to intensively address the issues of sustainability in the financial market. Below you have the opportunity to order our position paper, which contains seven key elements for the implementation of a sustainability strategy.

The legal standards governing emissions have become increasingly complex and opaque in recent years. Our whitepaper Emissions standards for vehicles: Euro 6, WLTP, Vecto and Co. provides an overview of the history of these regulations, the status in 2021, and upcoming changes. In addition to passenger cars, we cover light and heavy commercial vehicles.

With the current and future limit values, European legislators are setting the bar high for new vehicles. However, the ambitious requirements also open up opportunities for manufacturers. More realistic test procedures favor vehicles with low-emission powertrains. For example, the RDE (Real Driving Emission) method can be used to determine emissions during practical driving. To determine the fuel consumption and CO2 emissions of heavy commercial vehicles, the EU Commission publishes the simulation tool Vecto. Vecto can be adapted to the respective state of the art and enables direct comparison between different vehicle configurations.

Further tightening of fleet targets and limits is to be expected. In order to survive in global competition, vehicle manufacturers must prepare for the foreseeable development at an early stage and take targeted action.

Private banking and wealth management have been undergoing an accelerating process of change for years. Classic virtues such as relationship management remain important – especially against the backdrop of an increasingly complex world. At the same time, customers are making new demands: digital access, sustainable investment options, and individual configuration of performance are a few examples here.

But what exactly to do? Where to invest? How to secure profitability? Answering these questions requires a comprehensive analysis of the company’s own product and sales strategy. Ideally, it will be possible to refinance some of the necessary investments through the focused use of technology and changes to the service models offered. The Private Banking 2023 topic paper offers you concrete starting points for evaluating your business model and identifying areas for action.

Consileon has been assisting national and international private banks with strategic and operational issues for several years. We are at your disposal for an exchange and for support in implementation projects.

In fall 2019, the first issue of the new brand eins series on digitization was published with the aim of accompanying entrepreneurs and companies on their way to digitization. Even though the term had long been a buzzword at the time, it was still inevitably a foreign word or a closed book for many companies in this country.

Just one year later, the starting situation seems completely different – for companies as well as for society. Due to the Corona crisis, we have become more digital by necessity. We have set up home offices and learned to work predominantly remotely, communicate virtually and without major disruptions, and skillfully use new tools and techniques. All of this is also because most companies have upgraded in terms of digitization and are now much better positioned in terms of hardware, software and cloud services than they were before the crisis.

However, brand eins asks the legitimate question of whether companies have become better, faster and more efficient as a result; in other words, whether the virus can really be understood as a kind of “technology turbo,” as consultants and observers often claim. brand eins author Thomas Ramge has his doubts and questions above all whether the respective corporate cultures have been able to keep pace with the technological leap. He also does not see all IT service providers as winners in this respect.

In contrast, Statista has now investigated for the second time for brand eins which IT service providers companies in this country are in good hands with. Almost 5,800 experts – including 2,878 experts from the IT service providers themselves and 2,896 customers – took part in the survey and selected a total of 230 companies as the best IT service providers in Germany.

We are delighted to have found our place among Germany’s best IT service providers in only the second year of the survey. This is all the more gratifying because the survey – as is usual with the rankings by brand eins and Statista – is based roughly half on the recommendations of experts and half on those of customers. Since providers are not allowed to nominate themselves, the award-winning IT service providers must have a good reputation on the market and at the same time enjoy a high level of customer trust.

By Ralph Hientzsch, Dr. Peter von Koppenfels and Dr. Jürgen Stanowsky

How and whether the increase in the profit contribution from closed portfolios of life insurance succeeds depends to a large extent on the selection of the right strategy.

There are two basic ways to do this:

For more information, see this month’s Insurance Industry article, which you can download as a reprint here. (The article is in German.)

The Handelsblatt Annual Conference “Privatkundengeschäft”( engl. „Retail Banking“) took place again this year in Frankfurt on September 22 and 23, 2020 under the topic”Future Retail Banking”. For the 10th time in a row, Consileon accompanied this event as main sponsor and content partner. Despite Corona restrictions, more than 70 top decision makers from major and private banks, savings banks and cooperative banks as well as FinTechs discussed the future of retail banking.

A highlight of this high-profile event was the exclusive presentation of our new #RetailBanking2025 study by our managing partner, Ralph Hientzsch. With this study, we provide banks with a clear compass for realigning their retail banking – the Consileon 4C model. The model helps decision-makers to sustainably improve their performance in retail banking and to generate genuine customer enthusiasm in the process. At the heart of the model are 4 dimensions (4 “Cs”). The first dimension comprises the development of a Core Strategic Focus. In line with this, the core competencies are specifically developed. The third dimension of the model is the optimization of the transformation capability and the fourth and last dimension is the determination of customer enthusiasm as a result of the successful application of the model.

In addition to Ralph Hientzsch’s presentation, FinTechs, major banks and technology groups provided interesting insights into the future of retail banking, which were discussed intensively in the plenary session and during the conference breaks.

The two days have reinforced our realization that retail banking is on the brink of radical change. Banks that do not adapt to this change as quickly as possible will not be able to survive on the market in the long term.

We are happy to support you in mastering the upcoming change in a holistic way.

Development of a MARKETING.APP as the central module for sales advice and vehicle presentation. Expansion of the vehicle model range to include e-vehicles with additional implementation of an e-mobility special.

Scope: 600 person days (PT*)

*PT = person days à 8 hours